Question: Could someone assit please . . 2. You work for a company that sells whole life insurance policies. Your company charges a single premium for

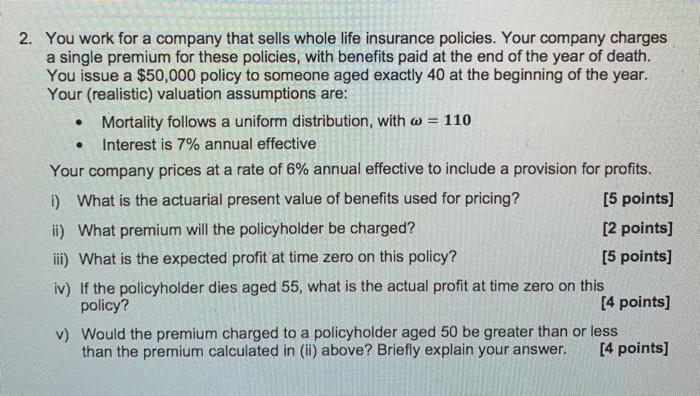

. . 2. You work for a company that sells whole life insurance policies. Your company charges a single premium for these policies, with benefits paid at the end of the year of death. You issue a $50,000 policy to someone aged exactly 40 at the beginning of the year. Your (realistic) valuation assumptions are: Mortality follows a uniform distribution, with w = 110 Interest is 7% annual effective Your company prices at a rate of 6% annual effective to include a provision for profits. i) What is the actuarial present value of benefits used for pricing? [5 points] ii) What premium will the policyholder be charged? [2 points] iii) What is the expected profit at time zero on this policy? [5 points] iv) If the policyholder dies aged 55, what is the actual profit at time zero on this policy? [4 points) v) Would the premium charged to a policyholder aged 50 be greater than or less than the premium calculated in (ii) above? Briefly explain your answer. [4 points] . . 2. You work for a company that sells whole life insurance policies. Your company charges a single premium for these policies, with benefits paid at the end of the year of death. You issue a $50,000 policy to someone aged exactly 40 at the beginning of the year. Your (realistic) valuation assumptions are: Mortality follows a uniform distribution, with w = 110 Interest is 7% annual effective Your company prices at a rate of 6% annual effective to include a provision for profits. i) What is the actuarial present value of benefits used for pricing? [5 points] ii) What premium will the policyholder be charged? [2 points] iii) What is the expected profit at time zero on this policy? [5 points] iv) If the policyholder dies aged 55, what is the actual profit at time zero on this policy? [4 points) v) Would the premium charged to a policyholder aged 50 be greater than or less than the premium calculated in (ii) above? Briefly explain your answer. [4 points]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts