Question: Could someone do both and show the process 7. Patton Paints, Inc. maintains a capital structure of 40% debt and 60% common equity; all of

Could someone do both and show the process

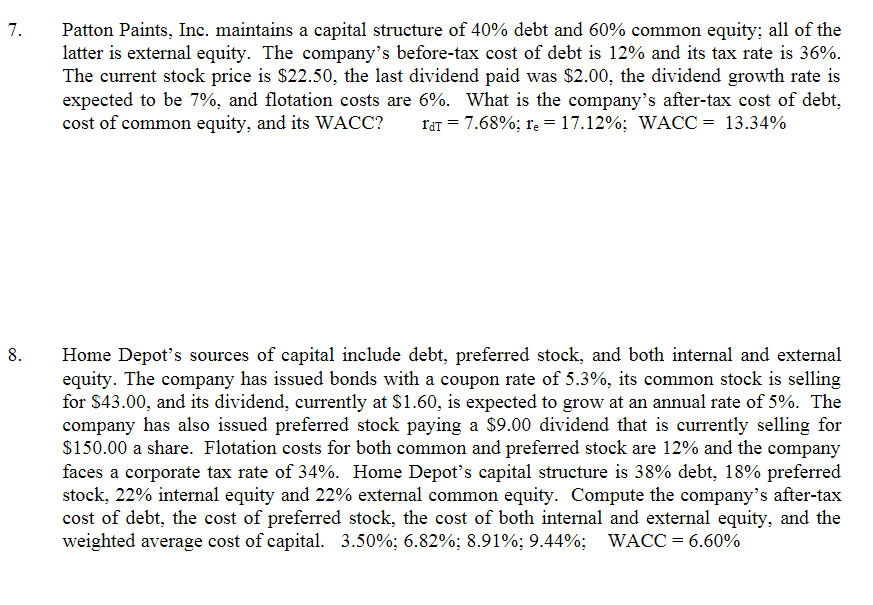

7. Patton Paints, Inc. maintains a capital structure of 40% debt and 60% common equity; all of the latter is external equity. The company's before-tax cost of debt is 12% and its tax rate is 36%. The current stock price is $22.50, the last dividend paid was $2.00, the dividend growth rate is expected to be 7%, and flotation costs are 6%. What is the company's after-tax cost of debt, cost of common equity, and its WACC? rat = 7.68%; re = 17.12%; WACC = 13.34% 8. Home Depot's sources of capital include debt, preferred stock, and both internal and external equity. The company has issued bonds with a coupon rate of 5.3%, its common stock is selling for $43.00, and its dividend, currently at $1.60, is expected to grow at an annual rate of 5%. The company has also issued preferred stock paying a $9.00 dividend that is currently selling for $150.00 a share. Flotation costs for both common and preferred stock are 12% and the company faces a corporate tax rate of 34%. Home Depot's capital structure is 38% debt, 18% preferred stock, 22% internal equity and 22% external common equity. Compute the company's after-tax cost of debt, the cost of preferred stock, the cost of both internal and external equity, and the weighted average cost of capital. 3.50%; 6.82%; 8.91%; 9.44%; WACC = 6.60%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts