Question: Could someone do this with handwritten calculations? I do not know where to start, and jow to interpret the data. Thanks DE PROTEGE Attention aux

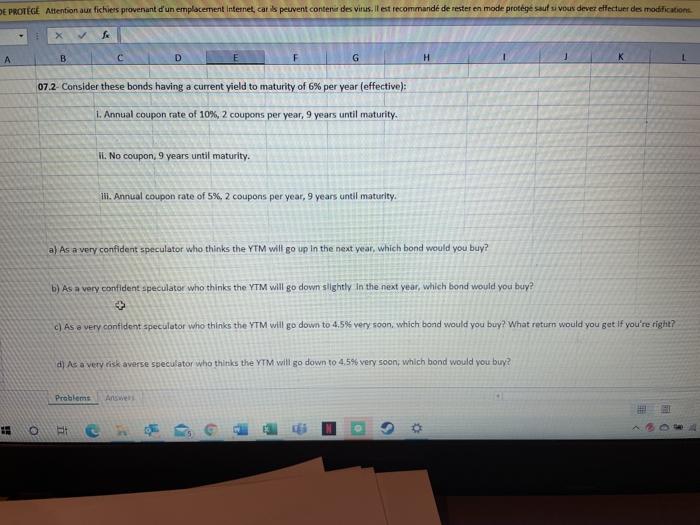

DE PROTEGE Attention aux fichiers provenant d'un emplacement Internet, car ils peuvent contenu des virus. Il est recommand de rester en mode protege sauf si vous devez effectuer des modifications A B D E F G K 07 2. Consider these bonds having a current yield to maturity of 6% per year (effective): 1. Annual coupon rate of 10%, 2 coupons per year, 9 years until maturity. II. No coupon, 9 years until maturity. 11. Annual coupon rate of 5%, 2 coupons per year, 9 years until maturity. a) As a very confident speculator who thinks the YTM will go up in the next year, which bond would you buy? b) As a very confident speculator who thinks the YTM will go down slightly in the next year, which bond would you buy? c) As a very confident speculator who thinks the YTM will go down to 4,5% very soon, which bond would you buy? What return would you get If you're right? d) As a very risk averse speculator who thinks the YTM will go down to 4,5% very soon, which bond would you buy? Problems Answers O G

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts