Question: could someone explain how to get this answer please, using a financial calculator Thanks Jake's Tree farm is evaluating a proposal to plant 5,000 ornamental

could someone explain how to get this answer please, using a financial calculator

could someone explain how to get this answer please, using a financial calculator

Thanks

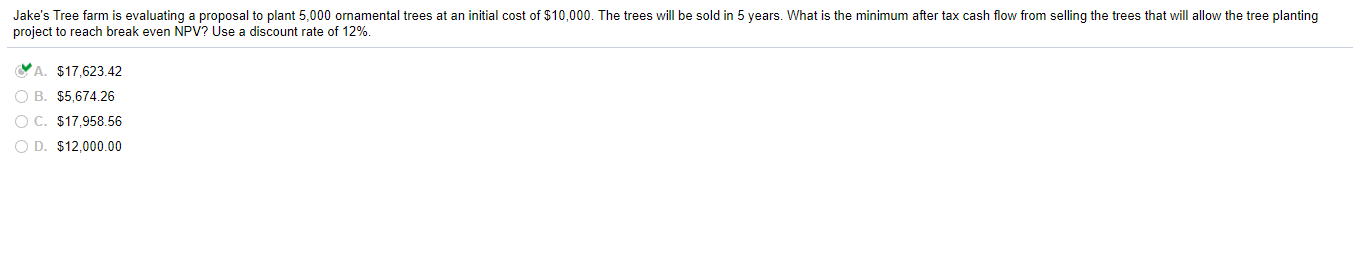

Jake's Tree farm is evaluating a proposal to plant 5,000 ornamental trees at an initial cost of $10,000. The trees will be sold in 5 years. What is the minimum after tax cash flow from selling the trees that will allow the tree planting project to reach break even NPV? Use a discount rate of 12%. A. $17,623.42 O B. $5,674.26 O C. $17,958,56 OD. $12,000.00

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock