Question: could someone explain this plz Question 18 (1 point) ABC Inc. is a very mature corporation. On Feb. 1, 2014, the company bought the equipment

could someone explain this plz

could someone explain this plz

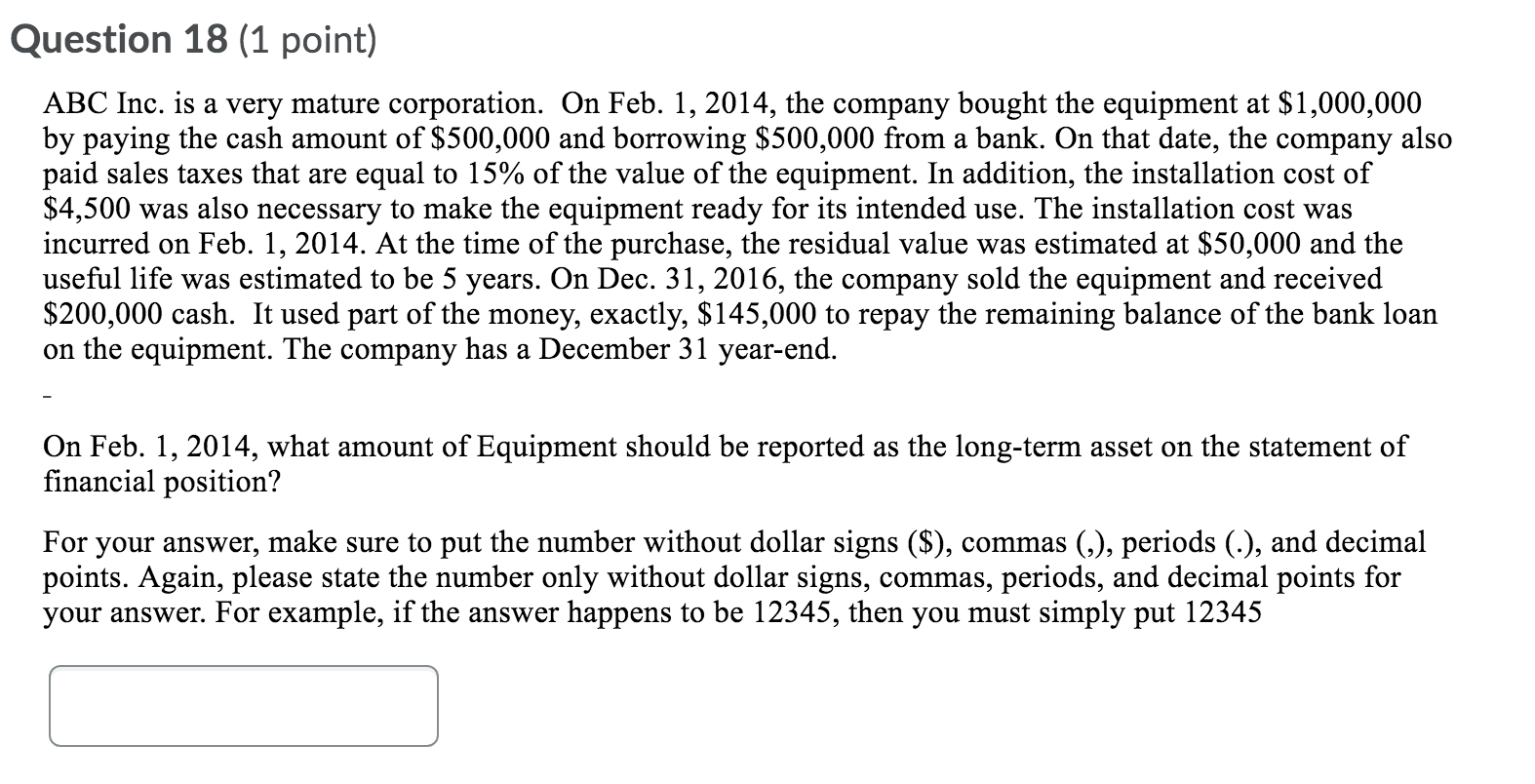

Question 18 (1 point) ABC Inc. is a very mature corporation. On Feb. 1, 2014, the company bought the equipment at $1,000,000 by paying the cash amount of $500,000 and borrowing $500,000 from a bank. On that date, the company also paid sales taxes that are equal to 15% of the value of the equipment. In addition, the installation cost of $4,500 was also necessary to make the equipment ready for its intended use. The installation cost was incurred on Feb. 1, 2014. At the time of the purchase, the residual value was estimated at $50,000 and the useful life was estimated to be 5 years. On Dec. 31, 2016, the company sold the equipment and received $200,000 cash. It used part of the money, exactly, $145,000 to repay the remaining balance of the bank loan on the equipment. The company has a December 31 year-end. On Feb. 1, 2014, what amount of Equipment should be reported as the long-term asset on the statement of financial position? For your answer, make sure to put the number without dollar signs ($), commas (,), periods (.), and decimal points. Again, please state the number only without dollar signs, commas, periods, and decimal points for your answer. For example, if the answer happens to be 12345, then you must simply put 12345

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts