Question: could someone help, and show their steps? I'm getting twisted up somewhere! (Estimated time allowance: 17 minutes) EarlyOne Inc. is start-up company and therefore is

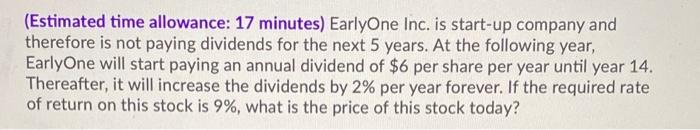

(Estimated time allowance: 17 minutes) EarlyOne Inc. is start-up company and therefore is not paying dividends for the next 5 years. At the following year, EarlyOne will start paying an annual dividend of $6 per share per year until year 14. Thereafter, it will increase the dividends by 2% per year forever. If the required rate of return on this stock is 9%, what is the price of this stock today

Step by Step Solution

There are 3 Steps involved in it

To find the price of the stock today we need to calculate the present value of all future dividends ... View full answer

Get step-by-step solutions from verified subject matter experts