Question: Could someone help me complete requirement 2 as shown below and requiremenr 4. Please make sure I can see the whole picture and answer when

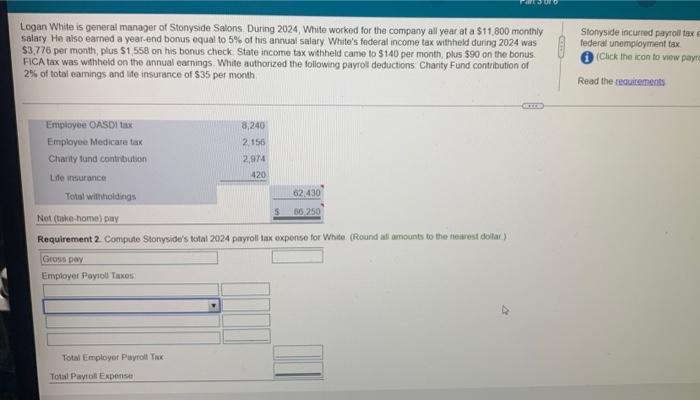

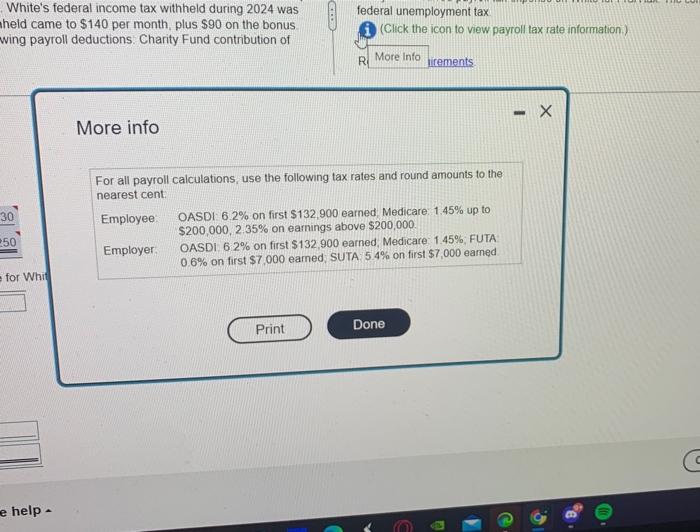

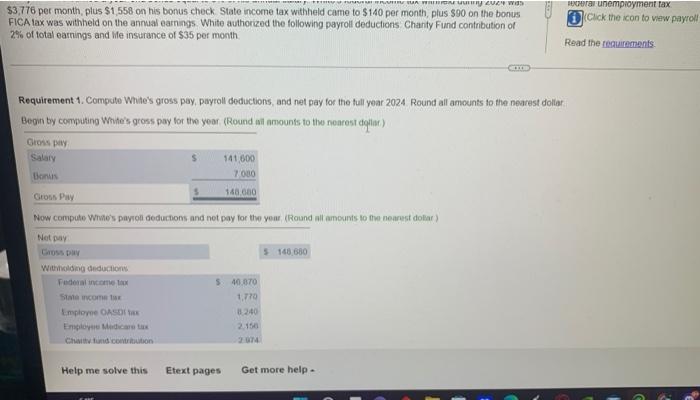

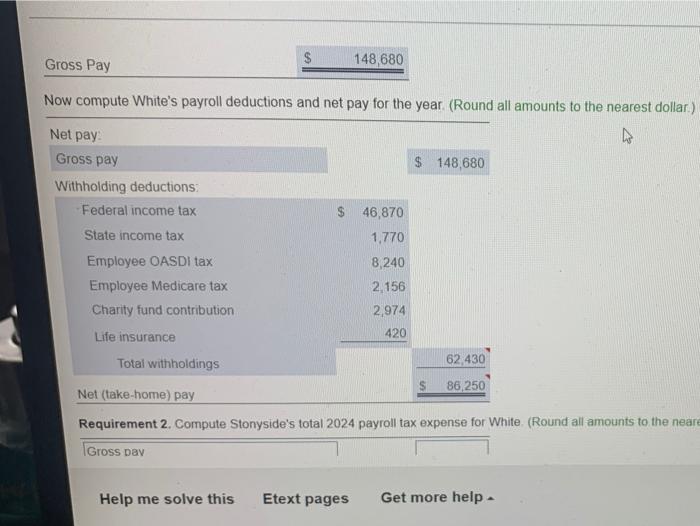

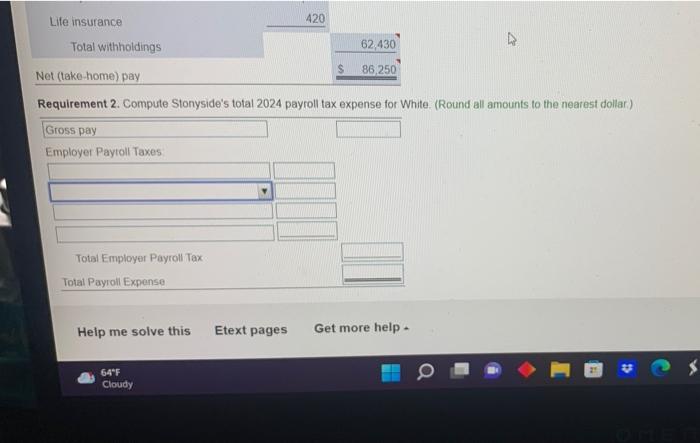

Logan White is general manager of Stonyside Salons During 2024, White worked for the company all year at a $11.800 monthly salary He also earned a year end bonus equal to 5% of his annual salary White's federal income tax withheld during 2024 was $3.776 per month, plus S1 558 on his bonus check State income tax withheld came to $140 per month plus 590 on the bonus FICA tax was withheld on the annual earnings White authorized the following payroll deductions Charity Fund contribution of 25. of total camnings and life insurance of $35 per month Stonyside incurred payroll tax federal unemployment tax Click the icon to view payre Read the requirements Employee OASD tax 8,240 Employee Medicate tax 2 156 Charity and contribution 2,974 Life insurance 420 62.430 Total withioldings 30/250 Not take home) pay Requirement 2. Compute Stonyside's total 2024 payroll tax expense for White (Round all amounts to the forest dollar) Gross pay Employer Payroll Takes Total Employer Payroll The Total Payron Expono White's federal income tax withheld during 2024 was held came to $140 per month, plus $90 on the bonus wing payroll deductions. Charity Fund contribution of federal unemployment tax (Click the icon to view payroll tax rate information.) RI More Info lirements - X More info For all payroll calculations, use the following tax rates and round amounts to the nearest cent 30 Employee 50 OASDI 6.2% on first $132.900 earned Medicare: 1.45% up to $200,000, 2 35% on earnings above $200,000 OASDI 6 2% on first $132,900 earned Medicare 1.45% FUTA 0.6% on first $7,000 earnedSUTA 5.4% on first $7,000 earned Employer for Whit Print Done e help SUPER AUCH W $3,776 per month, plus $1,558 on his bonus check State income tax withheld came to $140 per month, plus $90 on the bonus FICA tax was withheld on the annual earnings White authorized the following payroll deductions Chanty Fund contribution of 2% of total earings and Wife insurance of $35 per month curar unemployment fax Click the icon to view payroll Read the requirements GO Requirement 1. Computo White's gross pay, payroll doductions, and net pay for the full your 2024 Round all amounts to the nearest dollar Begin by computing White's gross pay for the year (Round will amounts to the nearest cogitar) Gions pay Salary $ 141.000 Bonus 7 000 180.000 Cross Pay Now computo Who's payron Geductions and not pay for the your Round will amounts to the nearest dollar) Net 5 145.680 COD Withholding deductions Federal income Stat com Employee CASO Emplo Medicare Chat.tund contribution $40.870 1,779 240 2.150 Help me solve this Etext pages Get more help Gross Pay $ 148,680 Now compute White's payroll deductions and net pay for the year (Round all amounts to the nearest dollar.) Net pay Gross pay $ 148,680 Withholding deductions: Federal income tax $ 46,870 State income tax 1,770 Employee OASDi tax 8,240 Employee Medicare tax 2.156 Charity fund contribution 2,974 420 Life insurance Total withholdings 62 430 Net (take-home) pay 86,250 Requirement 2. Compute Stonyside's total 2024 payroll tax expense for White (Round all amounts to the neare Gross Day Help me solve this Etext pages Get more help Life insurance 420 Total withholdings 62.430 S 86,250 Net (take home) pay Requirement 2. Compute Stonyside's total 2024 payroll tax expense for White. (Round all amounts to the nearest dollar) Gross pay Employer Payroll Taxes Total Employer Payroll Tax Total Payroll Expense Help me solve this Etext pages Get more help 64"F Cloudy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts