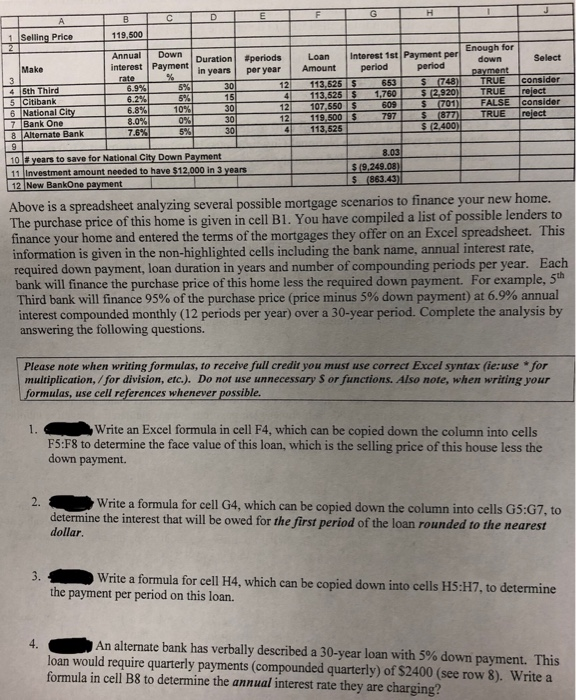

Question: Could someone help me do this please. I dont know how to do any of this :( 119,500 1Selling Price Enough for AnnualDown interest! Payment|n

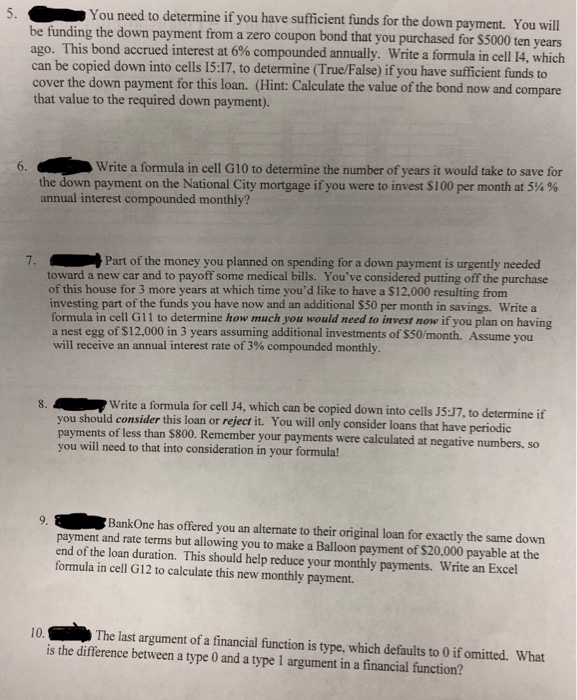

119,500 1Selling Price Enough for AnnualDown interest! Payment|n years! Durationpriods Loan Interest 1st Payment per down Select Make per year 6.9% 6.2% 6.8%) 8.0% 113,525 S 1,760 2.920) TRUE rejact 119.500 5$ (2400 4 5th 5 Citibank 15 12 107,550 609 701 FALSE Consider 1 7 Bank One 8Alternate Bank 400) 4 113,525 E years to save for National City Down Payment 11 Investment amount needed to have $12,000 in 3 years 12 New BankOne payment scenarios to finance your new home. Above is a spreadsheet analyzing several possible mortgage The purchase price of this home is given in cell B1. You have compiled a list of possible lenders to finance your home and entered the terms of the mortgages they offer on an Excel sp readsheet. This information is given in the non-highlighted cells including the bank name, annual interest rate required down payment, loan duration in years and number of compounding periods per year bank will finance the purchase price of this home less the required down payment. For example, 5 Third bank will finance 95% of the purchase price (price minus 5% down payment) at 6.9% annual interest compounded monthly (12 periods per year) over a 30-year period. Complete the analysis by answering the following questions. Each Please note when writing formulas, to receive full credit you must use correct Excel syntax (ie:use for multiplication, /for division, etc.). Do not use unnecessary S or functions. Also note writing your formulas, use cell references whenever possible. Write an Excel formula in cell F4, which can be copied down the column into cells F5:F8 to determine the face value of this loan, which is the selling price of this house less the down payment. 2. Write a formula for cell G4, which can be copied down the column into cells G5:G7, to determine the interest that will be owed for the first period of the loan rounded to the nearest dollar. 3. Write a formula for cell H4, which can be copied down into cells HS:H7, to determine the payment per period on this loan. An alternate bank has verbally described a 30-year loan with 5% down payment. This loan would require quarterly payments (compounded quarterly) of $2400 (see row 8). Write a formula in cell B8 to determine the annual interest rate they are charging

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts