Question: Could someone help me to solve this problem? Many thankss before. 9. Consider the following information about company G's performance and financial position in year

Could someone help me to solve this problem? Many thankss before.

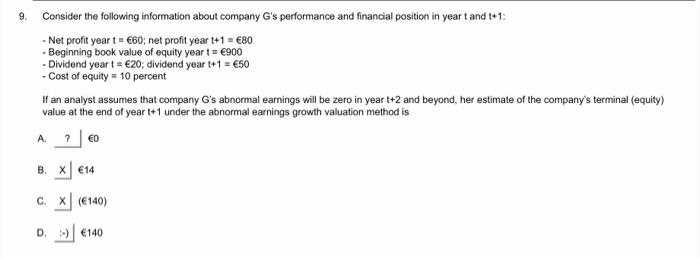

9. Consider the following information about company G's performance and financial position in year t and t+1: -Net profit year t = 60; net profit year t+1 = 80 Beginning book value of equity year t = 900 -Dividend year t = 20, dividend year t1 = 50 - Cost of equity = 10 percent If an analyst assumes that company G's abnormal earnings will be zero in year t+2 and beyond, her estimate of the company's terminal (equity) value at the end of yeart+1 under the abnormal earnings growth valuation method is A ? B. x 14 c. 140) D.) 140

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock