Question: Could someone help me work this problem out in excel please? Q4 Suppose you purchased a house 7 years ago and took out a mortgage

Could someone help me work this problem out in excel please?

Could someone help me work this problem out in excel please?

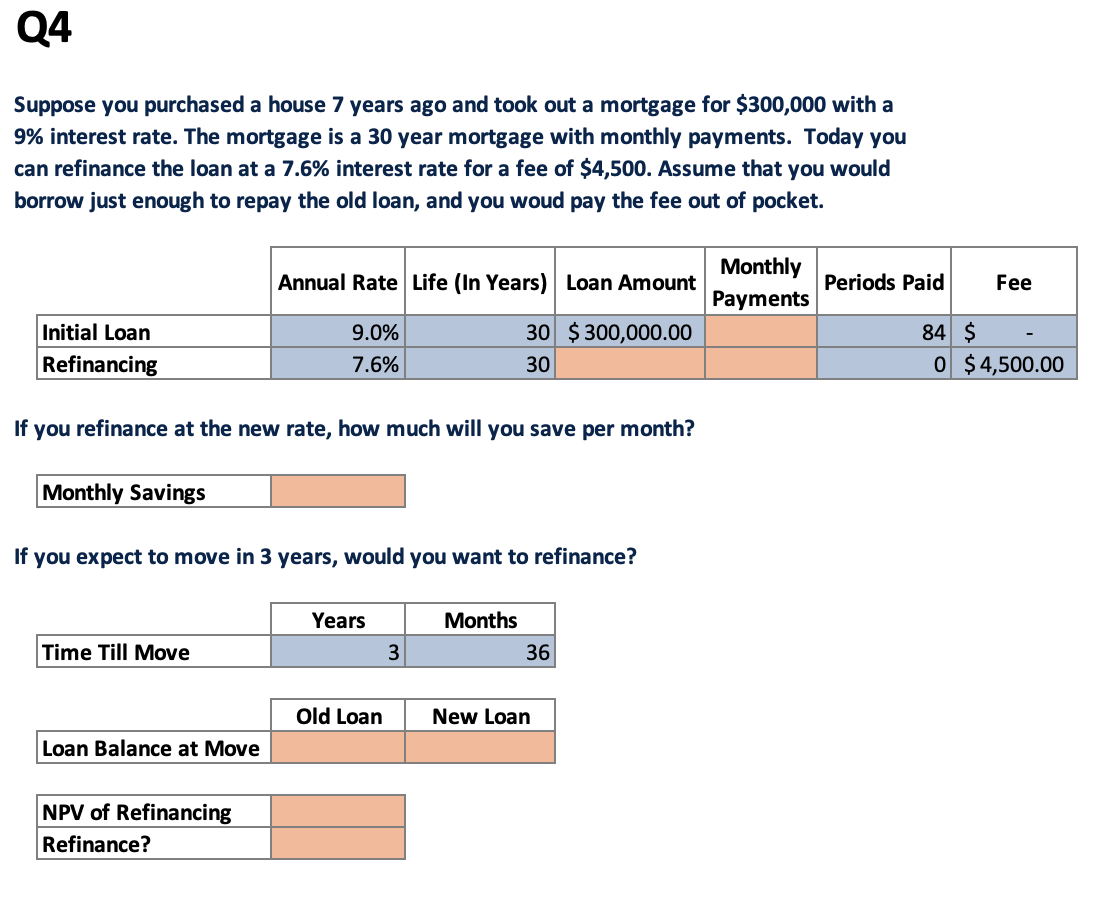

Q4 Suppose you purchased a house 7 years ago and took out a mortgage for $300,000 with a 9% interest rate. The mortgage is a 30 year mortgage with monthly payments. Today you can refinance the loan at a 7.6% interest rate for a fee of $4,500. Assume that you would borrow just enough to repay the old loan, and you woud pay the fee out of pocket. Annual Rate Life (In Years) Loan Amount Monthly Payments Periods Paid Fee Initial Loan Refinancing 9.0% 7.6% 30 $ 300,000.00 30 84 $ 0 $4,500.00 If you refinance at the new rate, how much will you save per month? Monthly Savings If you expect to move in 3 years, would you want to refinance? Years Months 36 Time Till Move 3 Old Loan New Loan Loan Balance at Move NPV of Refinancing Refinance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts