Question: Could someone help with these 2 problems? Show steps please. Thanks. QUESTION 1 You are the CFO of a U.S. MNC. You will receive EUR

Could someone help with these 2 problems? Show steps please. Thanks.

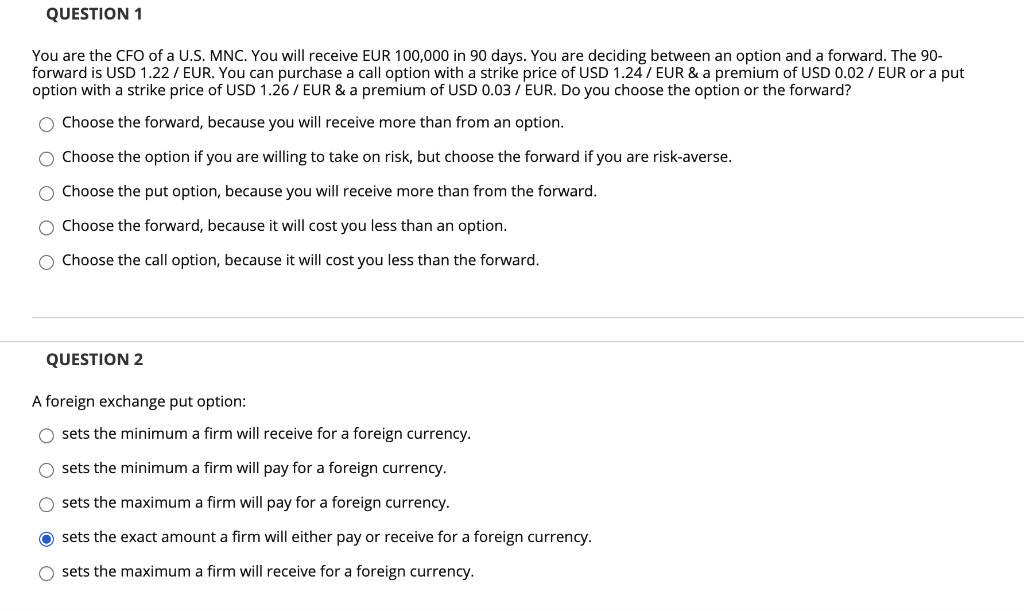

QUESTION 1 You are the CFO of a U.S. MNC. You will receive EUR 100,000 in 90 days. You are deciding between an option and a forward. The 90- forward is USD 1.22 / EUR. You can purchase a call option with a strike price of USD 1.24 / EUR & a premium of USD 0.02 / EUR or a put option with a strike price of USD 1.26 / EUR & a premium of USD 0.03 / EUR. Do you choose the option or the forward? Choose the forward, because you will receive more than from an option. Choose the option if you are willing to take on risk, but choose the forward if you are risk-averse. Choose the put option, because you will receive more than from the forward. Choose the forward, because it will cost you less than an option. Choose the call option, because it will cost you less than the forward. QUESTION 2 A foreign exchange put option: sets the minimum a firm will receive for a foreign currency. sets the minimum a firm will pay for a foreign currency. sets the maximum a firm will pay for a foreign currency. sets the exact amount a firm will either pay or receive for a foreign currency. sets the maximum a firm will receive for a foreign currency

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts