Question: could someone help with this one as well asap! ! Required information The following information applies to the questions displayed below! Super Saver Groceries purchased

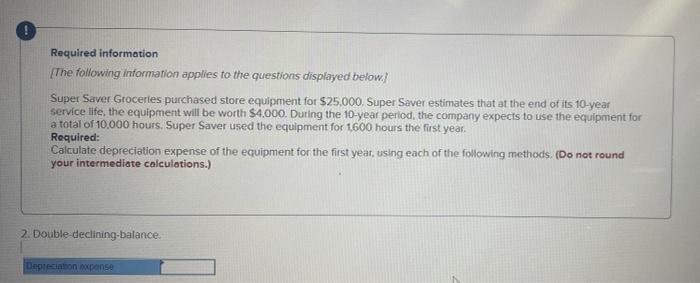

! Required information The following information applies to the questions displayed below! Super Saver Groceries purchased store equipment for $25,000. Super Saver estimates that at the end of its 10-year service life, the equipment will be worth $4,000. During the 10-year period, the company expects to use the equipment for a total of 10,000 hours. Super Saver used the equipment for 1600 hours the first year. Required: Calculate depreciation expense of the equipment for the first year, using each of the following methods. (Do not round your intermediate calculations.) 2. Double-declining balance. Depreci non pense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts