Question: Could someone please explain Exercise 2-1 (Algo) Compute a Predetermined Overhead Rate [LO2-1] Harris Fabrics computes its plantwide predetermined overhead rate annually on the basis

![Rate [LO2-1] Harris Fabrics computes its plantwide predetermined overhead rate annually on](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/671662002fc6f_127671661ff9f152.jpg)

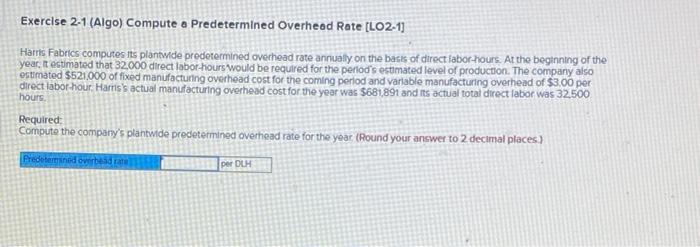

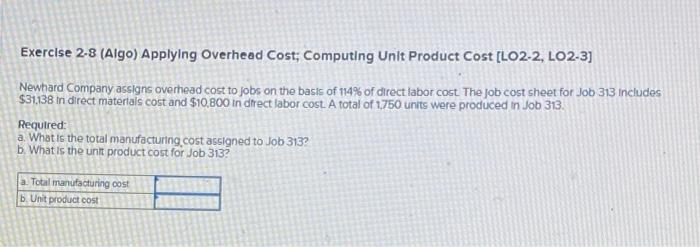

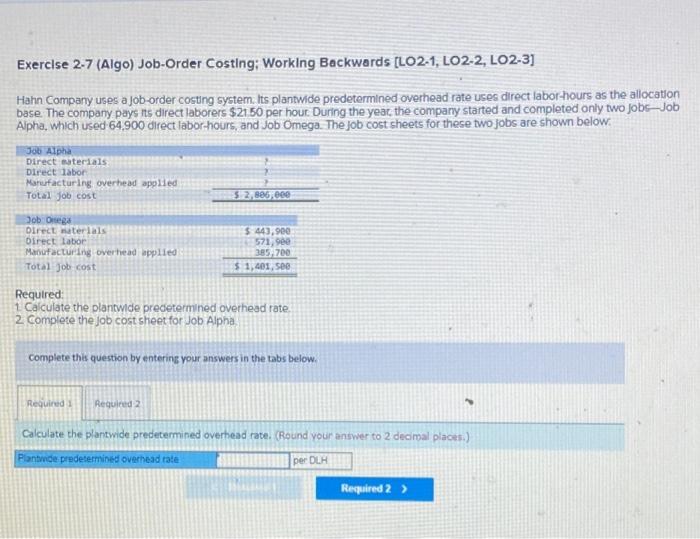

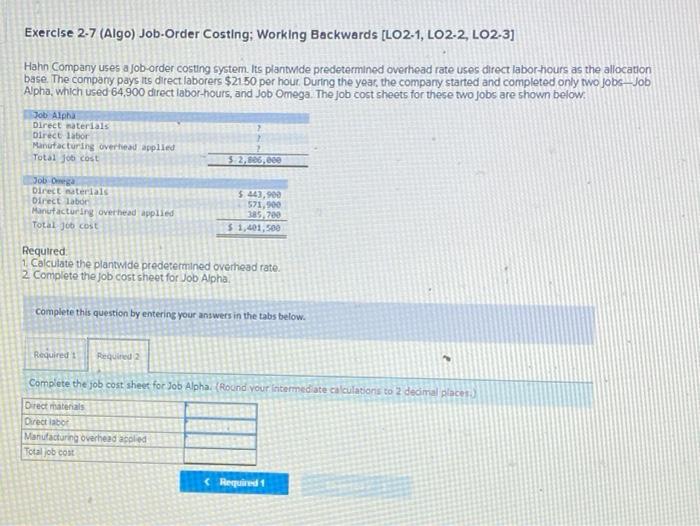

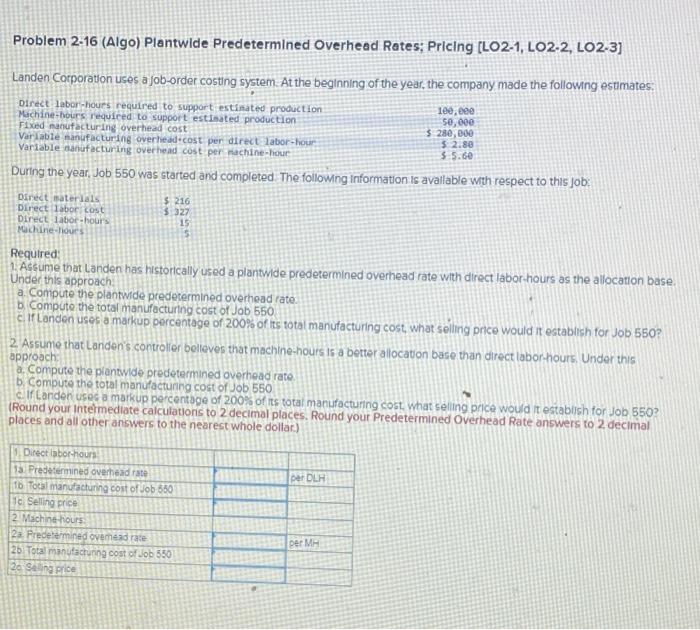

Exercise 2-1 (Algo) Compute a Predetermined Overhead Rate [LO2-1] Harris Fabrics computes its plantwide predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year. It stimated that 32,000 direct labor-hours would be required for the period's estimated level of production. The company also estimated $521.000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $3.00 per direct labor-hour Harris's actual manufacturing overhead cost for the year was $681891 and its actual total direct labor was 32.500 hours Required Compute the company's plantwide predetermined overhead rate for the year (Round your answer to 2 decimal places.) Predetermined overbeda per DLH Exercise 2-2 (Algo) Apply Overhead Cost to Jobs (LO2-2] Luthan Company uses a plantwide predetermined overhead rate of $22.90 per direct labor-hour. This predetermined rate was based on a cost formula that estimated $274,800 of total manufacturing overhead cost for an estimated activity level of 12,000 direct labor- hours The company incurred actual total manufacturing overhead cost of $269,000 and 12,100 total direct labor-hours during the period Required Determine the amount of manufacturing overhead cost that would have been applied to all jobs during the period. Manufacturing overhead applied Exercise 2-8 (Algo) Applying Overhead Cost; Computing Unit Product Cost [LO2-2, LO2-3] Newhard Company assigns overhead cost to jobs on the basis of 114% of direct labor cost. The job cost sheet for Job 313 includes $31138 in direct materials cost and $10,800 in direct labor cost. A total of 1,750 units were produced in Job 313. Required: a What is the total manufacturing cost assigned to Job 313? b. What is the unit product cost for Job 313? a Total manufacturing cost b. Unit product cost Exercise 2-7 (Algo) Job-Order Costing; Working Backwards [LO2-1, LO2-2, LO2-3] Hahn Company uses a Job-order costing system. Its plantwide predetermined overhead rate uses direct labor-hours as the allocation base. The company pays its direct laborers $21.50 per hour. During the year, the company started and completed only two Jobs Job Alpha, which used 64,900 direct labor-hours, and Job Omega. The job cost sheets for these two jobs are shown below. Job Alpha Direct materials. Direct labor Manufacturing overhead applied Total Job cost $2,806,000 Job Onega Direct materials $443,9 Direct labor 571,900 385,700 Manufacturing overhead applied Total Job cost $1,401,500 Required: 1. Calculate the plantwide predetermined overhead rate. 2 Complete the job cost sheet for Job Alpha Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate the plantwide predetermined overhead rate. (Round your answer to 2 decimal places.) Plantwide predetermined overhead rate per DLH Required 2 > Exercise 2-7 (Algo) Job-Order Costing; Working Backwards [LO2.1, LO2-2, LO2-3] Hahn Company uses a job order costing system. Its plantwide predetermined overhead rate uses direct labor-hours as the allocation base. The company pays its direct laborers $2160 per hour. During the year, the company started and completed only two Jobs - Job Alpha, which used 64,900 direct labor-hours, and Job Omega. The job cost sheets for these two jobs are shown below. Job Alpha Direct materials Direct labor Manufacturing overhead applied Total Job cost 52.506,00 Job Og Direct materials Direct labor Manutacturing overhead applied Total Job cost 5. 443,900 571,900 385 700 $ 1,401,500 Required 1. Calculate the plantwide predetermined overhead rate. 2. Complete the job cost sheet for Job Alpha complete this question by entering your answers in the tabs below. Required t Required 2 Complete the job cost sheet for 3ob Alpha (Round your intermediate calculations to 2 decimal placer Direct materials Direct labor Manufacturing overhead coled Total ob cont

Step by Step Solution

There are 3 Steps involved in it

Lets work through the questions one by one Exercise 21 Compute a Predetermined Overhead Rate Given Estimated direct laborhours 32000 hours Estimated f... View full answer

Get step-by-step solutions from verified subject matter experts