Question: Could someone please explain how to do the reciprocal method? Question C i) and ii) Question 1: Support Department Allocation Quinn Ltd is developing departmental

Could someone please explain how to do the reciprocal method? Question C i) and ii)

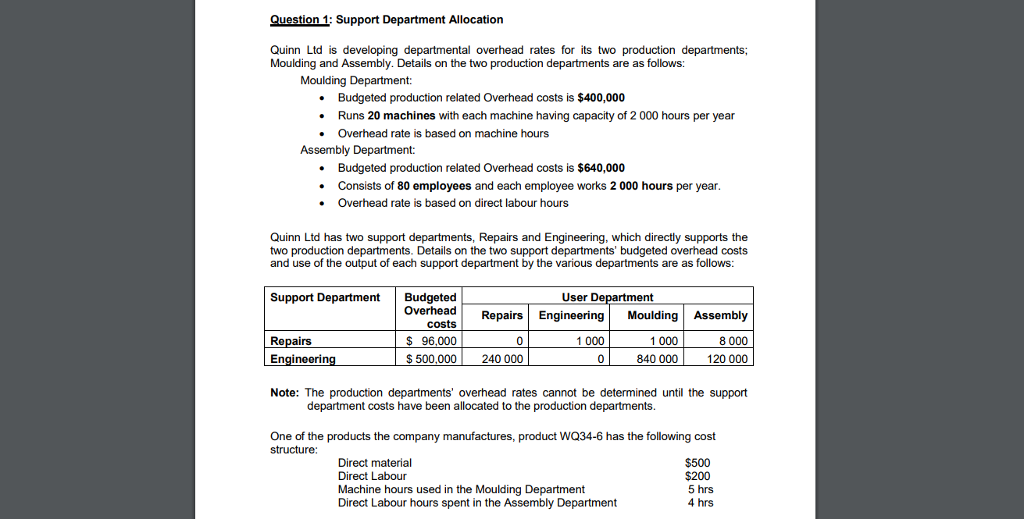

Question 1: Support Department Allocation Quinn Ltd is developing departmental overhead rates for its two production departments; Moulding and Assembly. Details on the two production departments are as follows: Moulding Department: .Budgeted production related Overhead costs is $400,000 .Runs 20 machines with each machine having capacity of 2 000 hours per year Overhead rate is based on machine hours Assembly Department: Budgeted production related Overhead costs is $640,000 Consists of 80 employees and each employee works 2 000 hours per year Overhead rate is based on direct labour hours Quinn Ltd has two support departments, Repairs and Engineering, which directly supports the two production departments. Details on the two support departments' budgeted overhead costs and use of the output of each support department by the various departments are as follows Support Department Budgeted User rtment Overhead costs 96,000 RepairsEngineering Moulding Assembly 8 000 120 000 1000 840 000 1 000 Repairs Engineeri 0 500,000 240 000 0 Note: The production departments' overhead rates cannot be determined until the support department costs have been allocated to the production departments. One of the products the company manufactures, product WQ34-6 has the following cost structure Direct material Direct Labour Machine hours used in the Moulding Department Direct Labour hours spent in the Assembly Department $500 $200 5 hrs 4 hrs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts