Question: Could someone please help me answer this. Thank you so much! Exercise 2-5 Statement of Financial Position Preparation On April 1, 2020, Anne invited Mary

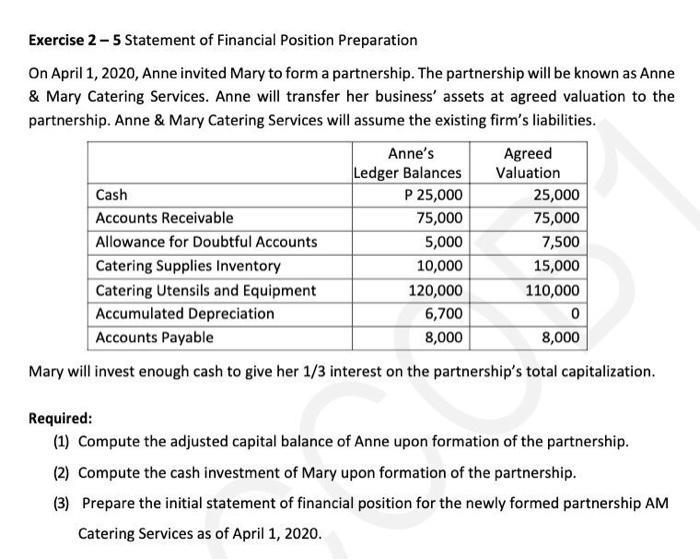

Exercise 2-5 Statement of Financial Position Preparation On April 1, 2020, Anne invited Mary to form a partnership. The partnership will be known as Anne & Mary Catering Services. Anne will transfer her business' assets at agreed valuation to the partnership. Anne & Mary Catering Services will assume the existing firm's liabilities. Anne's Agreed Ledger Balances Valuation Cash P 25,000 25,000 Accounts Receivable 75,000 Allowance for Doubtful Accounts 5,000 7,500 Catering Supplies Inventory 10,000 15,000 Catering Utensils and Equipment 120,000 110,000 Accumulated Depreciation 6,700 0 Accounts Payable 8,000 8,000 Mary will invest enough cash to give her 1/3 interest on the partnership's total capitalization. 75,000 Required: (1) Compute the adjusted capital balance of Anne upon formation of the partnership. (2) Compute the cash investment of Mary upon formation of the partnership. (3) Prepare the initial statement of financial position for the newly formed partnership AM Catering Services as of April 1, 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts