Question: could someone please help woth breakdown? Marin Golf Inc. was formed on July 1,2019, when Matt Magilke purchased the Old Master Golf Company. Old Master

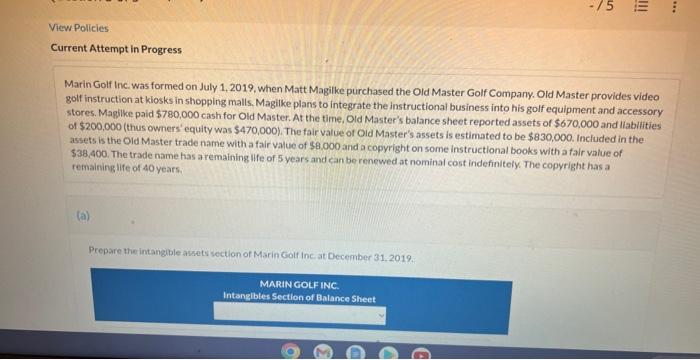

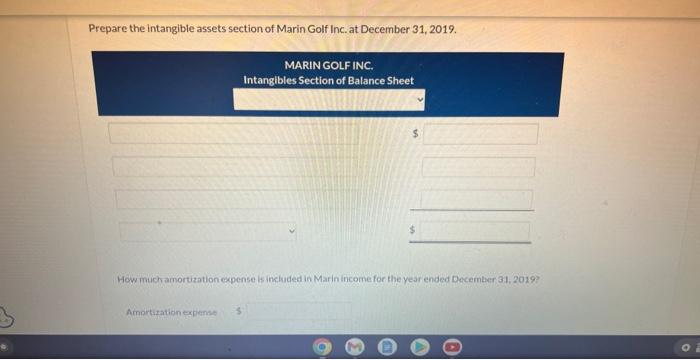

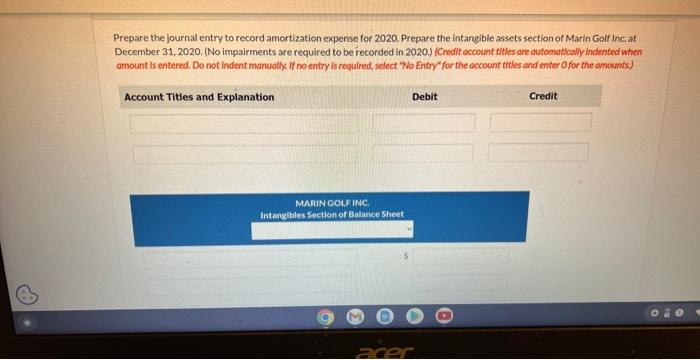

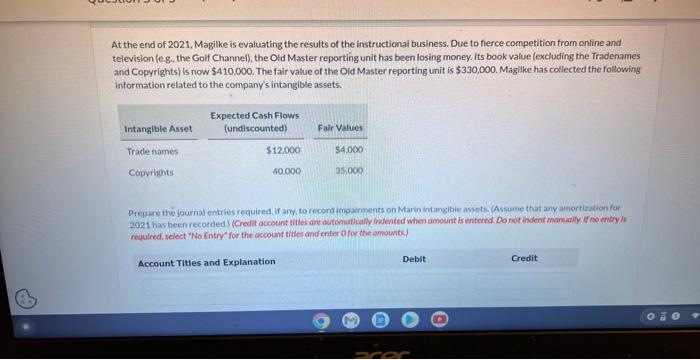

Marin Golf Inc. was formed on July 1,2019, when Matt Magilke purchased the Old Master Golf Company. Old Master provides video golf instruction at kiosks in shopping malls. Magike plans to integrate the instructional business into his golf equipment and accessory stores. Magike paid $780,000 cash for Old Master. At the time, Old Master's balance sheet reported assets of $670,000 and liabilities of $200,000 (thus owmers' equity was $470,000 ). The fair value of Oid Master's assets is estimated to be $830,000. Included in the assets is the Oid Master trade name with a fair value of $8,000 and a copyright on some instructional books with a falr value of $38,400. The trade name has a remaining ilfe of 5 years and can be renewed at nominal cost indefinitely. The copyright has a remaining life of 40 years. (a) Prepare the intangible assets section of Marin Eolf inc at December 31.2019 Prepare the intangible assets section of Marin Golf Inc. at December 31, 2019. How much amortization experse is inckuded in Marin income for the year ended December 31,20193 Prepare the journal entry to record amortization expense for 2020 . Prepare the intanglble assets section of Marin Golf Inc at December 31, 2020. (No impairments are required to be recorded in 2020.) (Credit account fitles are automatkally indented when amount is entered. Do not indent manually, If no entry is required, select "No Entry" for the occount tirles and enter Ofor the amounts) At the end of 2021, Magilke is evaluating the results of the instructional business. Due to fierce competition from onfine and television (e.g, the Golf Channel), the Oid Master reporting unit has been losing money. Its book value (excluding the Tradenames and Copyrights) is now $410,000. The fair value of the Old Master reporting unit is $330,000. Magilke has collected the following information related to the company's intangible assets. Drepare the journai entries required, if amy, to record imparments on Marin intangibiet assets. (Assume that any amortiration for 2021 has been recorded \}Credit account tilles are outcematlcaliy indented when amount is entered. Do not indent manuoily if no entiy in nequired, select "No Entry" for the occount tithes and enis 0 por the amountsd

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts