Question: Could someone please solve these on Excel and show me how? Example 1 Your company is evaluating a new project that will require the purchase

Could someone please solve these on Excel and show me how?

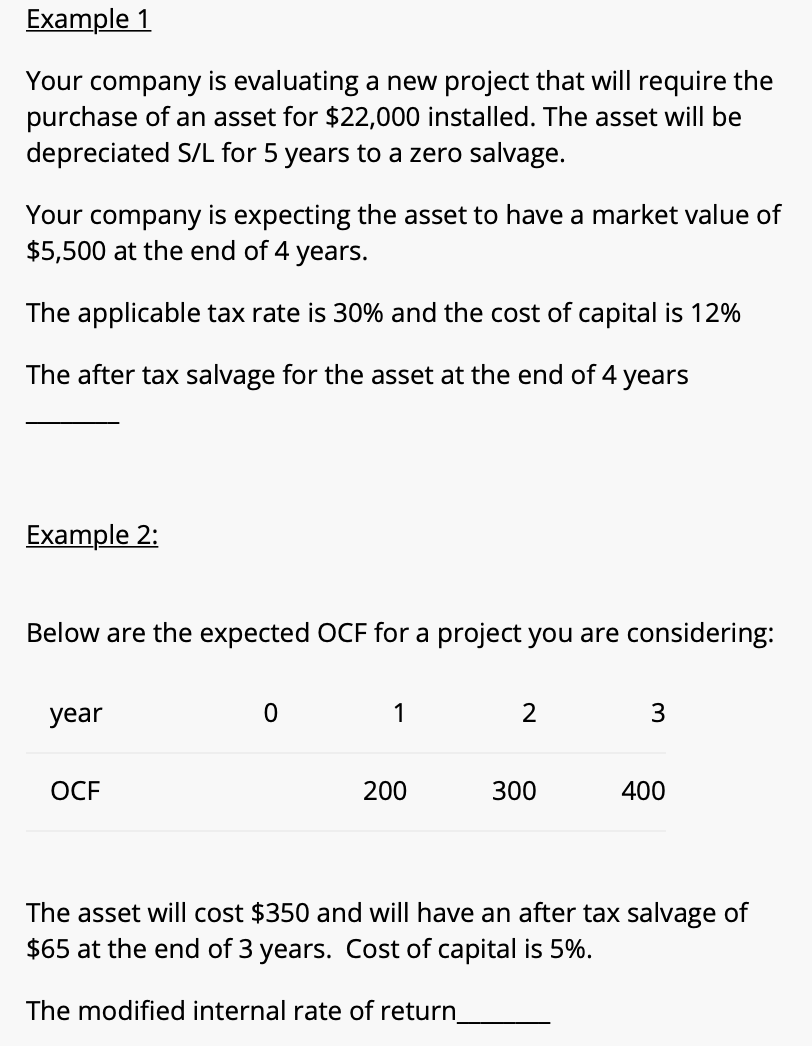

Example 1 Your company is evaluating a new project that will require the purchase of an asset for $22,000 installed. The asset will be depreciated S/L for 5 years to a zero salvage. Your company is expecting the asset to have a market value of $5,500 at the end of 4 years. The applicable tax rate is 30% and the cost of capital is 12% The after tax salvage for the asset at the end of 4 years Example 2: Below are the expected OCF for a project you are considering: year 0 1 2 3 OCF 200 300 400 The asset will cost $350 and will have an after tax salvage of $65 at the end of 3 years. Cost of capital is 5%. The modified internal rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts