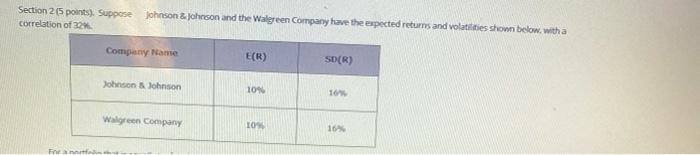

Question: could someone probide correct answers Section 25 points). Suppose Johnson & Johnson and the Walgreen Company have the expected returns and volatilities shown below. with

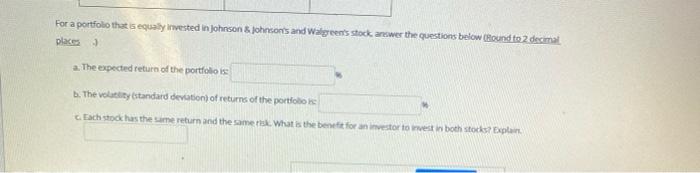

Section 25 points). Suppose Johnson & Johnson and the Walgreen Company have the expected returns and volatilities shown below. with a correlation of 22% Company Name E(R) SD(R) Johnson & Johnson 109 16 Walgreen Company Finni For a portfolio that is equally invested in Johnson & Johnson's and Walgreen's stock answer the questions below (Round to 2 decimal places a. The expected return of the portfolio is . The volatility standard deviation of returns of the portfolio Each stock has the same return and the same is What is the benefit for an investor to invest in both stocks? Explan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts