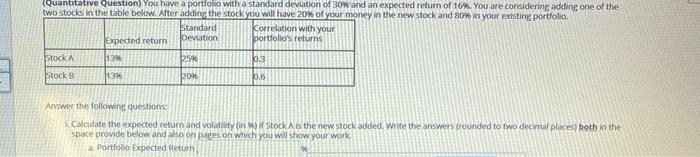

Question: could someone probide the answer and show work on how you got the answer also draw a timeline for the answer too (Quantitative Question) You

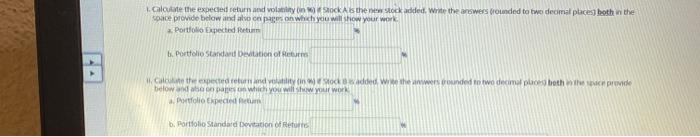

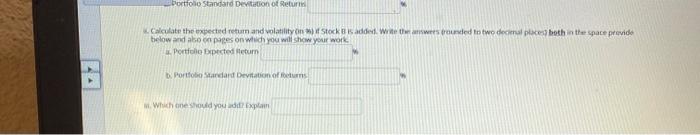

(Quantitative Question) You have a portfolio with a standard deviation of Bow and an expected return of 16. You are considering adding one of the two stocks in the table below. After adding the stock you will have 20% of your money in the new stock and 80% in your existing portfolio Standard Korrelation with your Expected return Deviation portfolio's returns Stock A 1394 25% 6.3 Stock 13% 20W 0.6 Answer the following questions Calculate the expected return and volatility in ) if Stock As the new stock added. Write the answers (rounded to two decimal places) both in the space provide below and also on pages on which you will show your work a: Portfolio Expected Return the expected certum and laty Akadded. Write the rowers crounded to two decimal places both the space provide below which you will show your work Portfolio Expected Return b. Portfolio Standard deviation of Cac the expected return intock added the wines under two decimal por both the provide below and are on which you will your work tfolio precede b. Portfolio Standard deviation of Reports Portfolio Standard deviation of Returns Calculate the expected return and volatility on Stock added. Wouvied in two decimales both in the space provide below and abocpapes on which you will show your work Portfolio Expected Return Portfondart Deviation of Which one should you expl

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts