Question: could someone provide correct answers (Show Work for this Quantitative Question There are two sections to this question, each with multiple parts. You must write

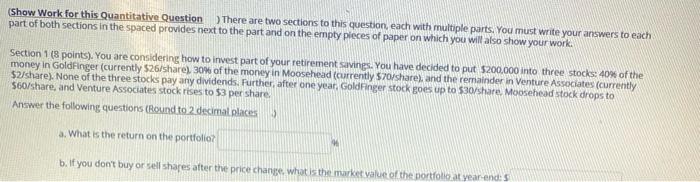

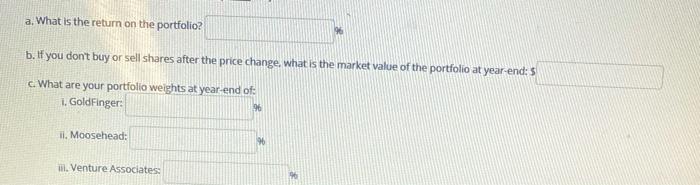

(Show Work for this Quantitative Question There are two sections to this question, each with multiple parts. You must write your answers to each part of both sections in the spaced provides next to the part and on the empty pieces of paper on which you will also show your work. Section 1 (8 points). You are considering how to invest part of your retirement Savings. You have decided to put $200,000 into three stocks: 40% of the money in Goldfinger (currently $26/sharel 30% of the money in Moosehead (currently 570/share), and the remainder in Venture Associates (currently $2/share). None of the three stocks pay any dividends. Further, after one year, Goldinger stock goes up to $30/share. Moosehead stock drops to 560/share, and Venture Associates stock rises to $3 per share Answer the following questions (Round to 2 decimal places a. What is the return on the portfolio b. If you don't buy or sell shares after the price change. what is the market value of the portfolio at year-end: 5 a. What is the return on the portfolio? b. If you don't buy or sell shares after the price change, what is the market value of the portfolio at year-end: 5 What are your portfolio weights at year-end of: 1. Goldfinger: il. Moosehead: Ill. Venture Associates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts