Question: Could someone show me how to do question e. I have the answers for the rest. Thanks! P11.38A (LO 2, 3) High Arctic Manufacturing Company

Could someone show me how to do question e. I have the answers for the rest. Thanks!

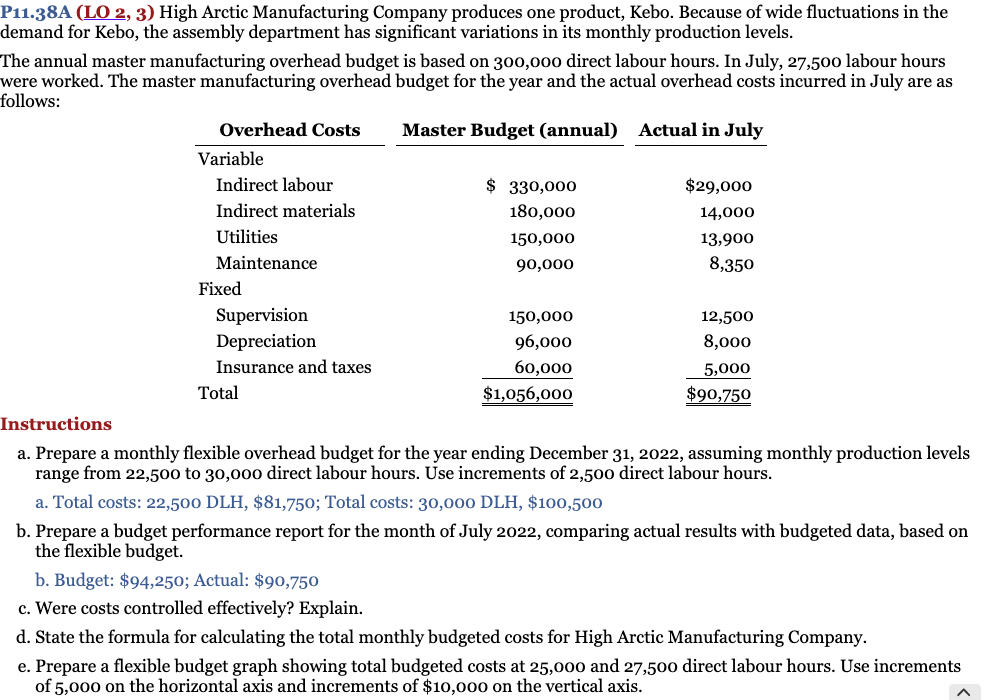

P11.38A (LO 2, 3) High Arctic Manufacturing Company produces one product, Kebo. Because of wide fluctuations in the demand for Kebo, the assembly department has significant variations in its monthly production levels. The annual master manufacturing overhead budget is based on 300,000 direct labour hours. In July, 27,500 labour hours were worked. The master manufacturing overhead budget for the year and the actual overhead costs incurred in July are as follows: Overhead Costs Master Budget (annual) Actual in July Variable Indirect labour $ 330,000 $29,000 Indirect materials 180,000 14,000 Utilities 150,000 13,900 Maintenance 90,000 8,350 Fixed Supervision 150,000 12,500 Depreciation 96,000 8,000 Insurance and taxes 60,000 5,000 Total $1,056,000 $90,750 Instructions a. Prepare a monthly flexible overhead budget for the year ending December 31, 2022, assuming monthly production levels range from 22,500 to 30,000 direct labour hours. Use increments of 2,500 direct labour hours. a. Total costs: 22,500 DLH, $81,750; Total costs: 30,000 DLH, $100,500 b. Prepare a budget performance report for the month of July 2022, comparing actual results with budgeted data, based on the flexible budget. b. Budget: $94,250; Actual: $90,750 c. Were costs controlled effectively? Explain. d. State the formula for calculating the total monthly budgeted costs for High Arctic Manufacturing Company. e. Prepare a flexible budget graph showing total budgeted costs at 25,000 and 27,500 direct labour hours. Use increments of 5,000 on the horizontal axis and increments of $10,000 on the vertical axis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts