Question: could someone show me how to work these out ? QUESTION 5 Consider a bond which has a face value of $2,000, a coupon of

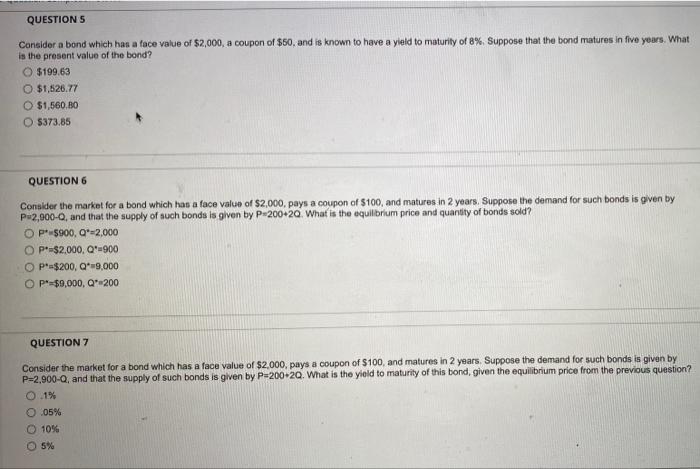

QUESTION 5 Consider a bond which has a face value of $2,000, a coupon of $50, and is known to have a yield to maturity of 8%. Suppose that the bond matures in five years. What is the present value of the bond? O $199.63 O $1,526.77 O $1,560.80 O $373.85 QUESTION 6 Consider the market for a bond which has a face value of $2,000, pays a coupon of $100, and matures in 2 years. Suppose the demand for such bonds is given by P=2,900-Q, and that the supply of such bonds is given by P-200+2Q. What is the equilibrium price and quantity of bonds sold? OP $900, Q=2,000 OP $2,000, Q-900 OP $200, Q-9,000 OP $9,000, Q* 200 QUESTION 7 Consider the market for a bond which has a face value of $2,000, pays a coupon of $100, and matures in 2 years. Suppose the demand for such bonds is given by P=2,900-Q, and that the supply of such bonds is given by P=200+2Q. What is the yield to maturity of this bond, given the equilibrium price from the previous question? 0.1% .05% 10% 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts