Question: Could this please be checked for me: A bond matures in 10 years. The bond has a coupon rate of 5% paid semi-annually and its

Could this please be checked for me:

A bond matures in 10 years. The bond has a coupon rate of 5% paid semi-annually and its face value is $1000. The market interest rate for similar bonds is 7%.

What is the value of this bond?

FV = $1000

CF = 5% x FV = $50

i = 7%

n = 10 years

m = 2 (Semi-annually)

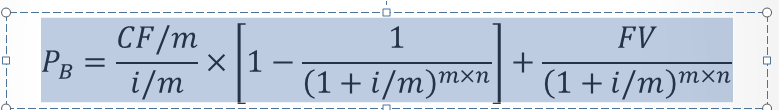

= 50/2 / 0.07/2 x [1 - 1 / (1+0.07/2)^2x10] + 1000 / (1+0.07/2)^2x10

= 25/.14 x [1- 1 / (1+0.035)^20] + 1000 / (1+.035)^20

= 178.5714285 x [ 1 - 1 / (1.035)^20] + 1000 / (1.035)^20

= 178.5714285 x [ 1 - 1 / 1.989788863465846] + 1000 / 1.989788863465846

= 178.5714285 x [1 - 0.50256588443166982] + 502.565878652811814495

= 178.5714285 x [0.49743411556833018] + 502.565878652811814495

= 88.82752060167080960226213 + 502.565878652811814495

= 591.39339925448262409726213

= $591.39

The value of the bond is $591.39

The bond is sold at a discount of $408.61

Discount = $1000 - $591.39

FV CF/m n n

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts