Question: Could u answer this homework please . - The book value of Amazon' equity, preferred stock and debt are $8 billion, $3 billion, and $26

Could u answer this homework please .

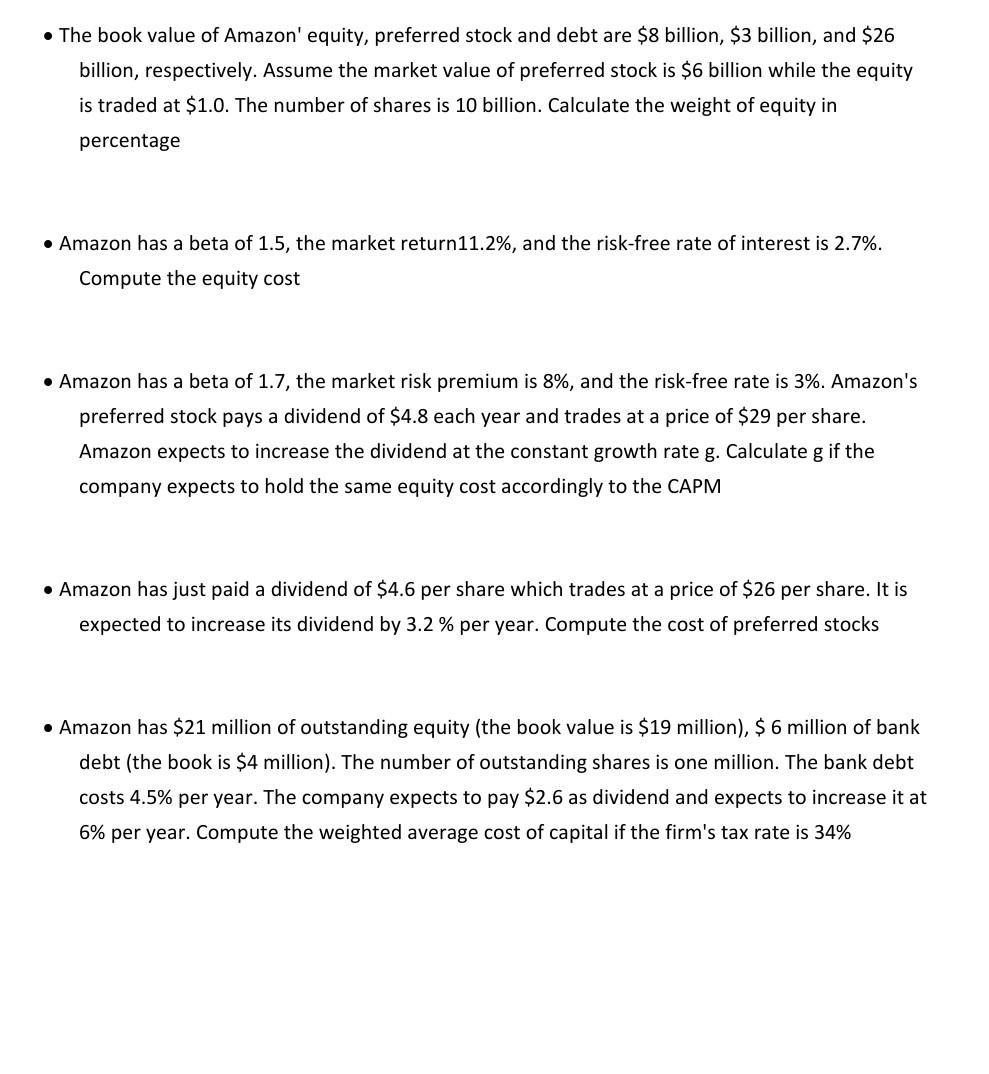

- The book value of Amazon' equity, preferred stock and debt are $8 billion, $3 billion, and $26 billion, respectively. Assume the market value of preferred stock is $6 billion while the equity is traded at $1.0. The number of shares is 10 billion. Calculate the weight of equity in percentage - Amazon has a beta of 1.5, the market return11.2\%, and the risk-free rate of interest is 2.7%. Compute the equity cost - Amazon has a beta of 1.7 , the market risk premium is 8%, and the risk-free rate is 3%. Amazon's preferred stock pays a dividend of $4.8 each year and trades at a price of $29 per share. Amazon expects to increase the dividend at the constant growth rate g. Calculate g if the company expects to hold the same equity cost accordingly to the CAPM - Amazon has just paid a dividend of $4.6 per share which trades at a price of $26 per share. It is expected to increase its dividend by 3.2% per year. Compute the cost of preferred stocks - Amazon has $21 million of outstanding equity (the book value is $19 million), \$ 6 million of bank debt (the book is $4 million). The number of outstanding shares is one million. The bank debt costs 4.5% per year. The company expects to pay $2.6 as dividend and expects to increase it at 6% per year. Compute the weighted average cost of capital if the firm's tax rate is 34%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts