Question: Could u pls explain the part (c) answer? Company A and Company B are identical companies except that Company A capitalizes a recent asset purchase

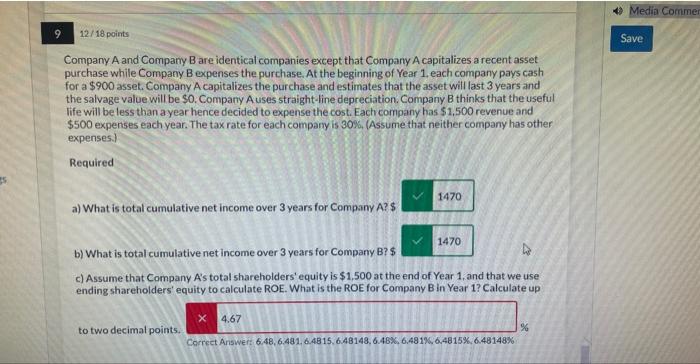

Company A and Company B are identical companies except that Company A capitalizes a recent asset purchase while Company B expenses the purchase. At the beginning of Year 1, each company pays cash for a $900 asset. Company A capitalizes the purchase and estimates that the asset will last 3 years and the salvage value will be \$0. Company A uses straight-line depreciation. Company B thinks that the useful life will be less than a year hence decided to expense the cost. Each company has $1,500 revenue and $500 expenses each year. The tax rate for each company is 30%. (Assume that neither company has other expenses.) Required a) What is total cumulative net income over 3 years for Company A ? $ b) What is total cumulative net income over 3 years for Company B? $ c) Assume that Company A's total shareholders' equity is $1,500 at the end of Year 1 , and that we use ending shareholders' equity to calculate ROE. What is the ROE for Company B in Year 1 ? Calculate up to two decimal points. Correct Answer: 6.48,6.481,6.4815,6.48148,6.48%,6.481%,6.4815%,6.48148%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts