Question: could use some help understanding this. thank you! Required information [The following information applies to the questions displayed below) Delph Company uses a Job-order costing

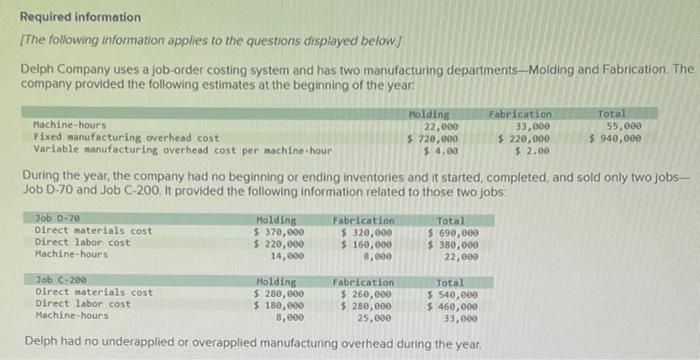

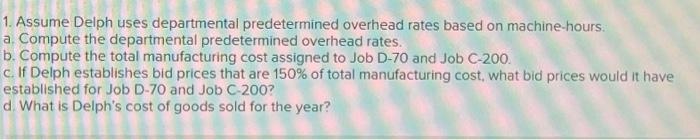

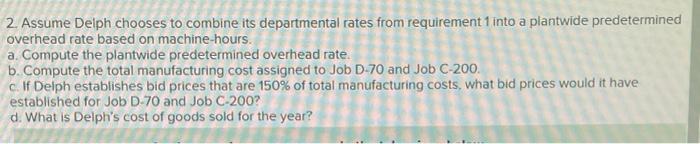

Required information [The following information applies to the questions displayed below) Delph Company uses a Job-order costing system and has two manufacturing departmentsMolding and Fabrication. The company provided the following estimates at the beginning of the year Holdings Fabrication Total Machine-hours 22.000 33,000 55,000 Fixed manufacturing overhead cost $ 220,000 $ 220,000 $ 940,000 Variable manufacturing overhead cost per machine hour $ 4.00 $ 2.00 During the year, the company had no beginning or ending inventories and it started, completed, and sold only two jobs- Job D-70 and Job C-200. It provided the following information related to those two jobs Job D-70 Molding Fabrication Total Direct materials cost $ 370,000 $ 320,000 $ 690,000 Direct labor cost $ 220,000 $ 160,000 $ 380,000 Machine-hours 14,000 8.000 22,000 Job C-200 Holding Fabrication Total Direct materials cost $ 280,000 $ 260,000 $540,000 Direct labor cost $ 180,000 $ 280,000 $ 460,000 Machine-hours 8,000 25,000 33,000 Delph had no underapplied or overapplied manufacturing overhead during the year 1. Assume Delph uses departmental predetermined overhead rates based on machine hours. a Compute the departmental predetermined overhead rates. b. Compute the total manufacturing cost assigned to Job D-70 and Job C-200. c. If Delph establishes bid prices that are 150% of total manufacturing cost, what bid prices would it have established for Job D-70 and Job C-2007 d. What is Delph's cost of goods sold for the year? 2. Assume Delph chooses to combine its departmental rates from requirement into a plantwide predetermined overhead rate based on machine hours. a. Compute the plantwide predetermined overhead rate. b. Compute the total manufacturing cost assigned to Job D-70 and Job C-200. c. If Delph establishes bid prices that are 150% of total manufacturing costs, what bid prices would it have established for Job D-70 and Job C-200? d. What is Delph's cost of goods sold for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts