Question: Could use some help with this problem Finance 431 Stock Valuation Assignment #2 In this problem, you are going to calculate the present value of

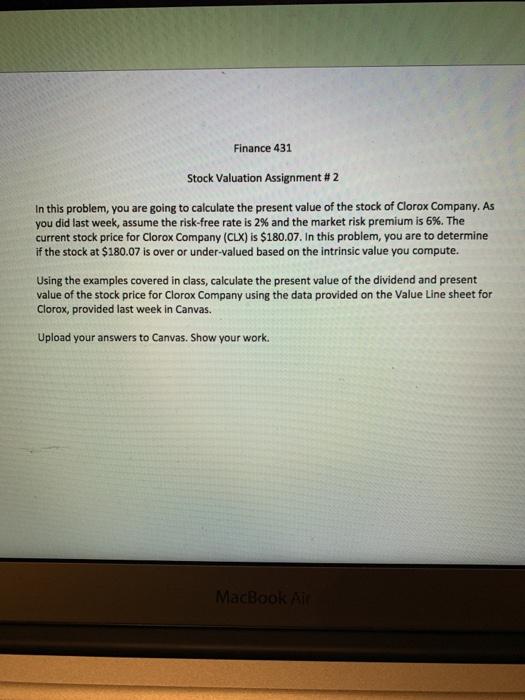

Finance 431 Stock Valuation Assignment #2 In this problem, you are going to calculate the present value of the stock of Clorox Company. As you did last week, assume the risk-free rate is 2% and the market risk premium is 6%. The current stock price for Clorox Company (CLX) is $180.07. In this problem, you are to determine if the stock at $180.07 is over or under-valued based on the intrinsic value you compute. Using the examples covered in class, calculate the present value of the dividend and present value of the stock price for Clorox Company using the data provided on the Value Line sheet for Clorox, provided last week in Canvas. Upload your answers to Canvas. Show your work. MacBook Ai Finance 431 Stock Valuation Assignment #2 In this problem, you are going to calculate the present value of the stock of Clorox Company. As you did last week, assume the risk-free rate is 2% and the market risk premium is 6%. The current stock price for Clorox Company (CLX) is $180.07. In this problem, you are to determine if the stock at $180.07 is over or under-valued based on the intrinsic value you compute. Using the examples covered in class, calculate the present value of the dividend and present value of the stock price for Clorox Company using the data provided on the Value Line sheet for Clorox, provided last week in Canvas. Upload your answers to Canvas. Show your work. MacBook Ai

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts