Question: Could you also include parts B for both and C, plz and thank you (Related to Checkpoint 9.2) (Yield to maturity) The Saleemi Corporation's $1,000

Could you also include parts B for both and C, plz and thank you

Could you also include parts B for both and C, plz and thank you

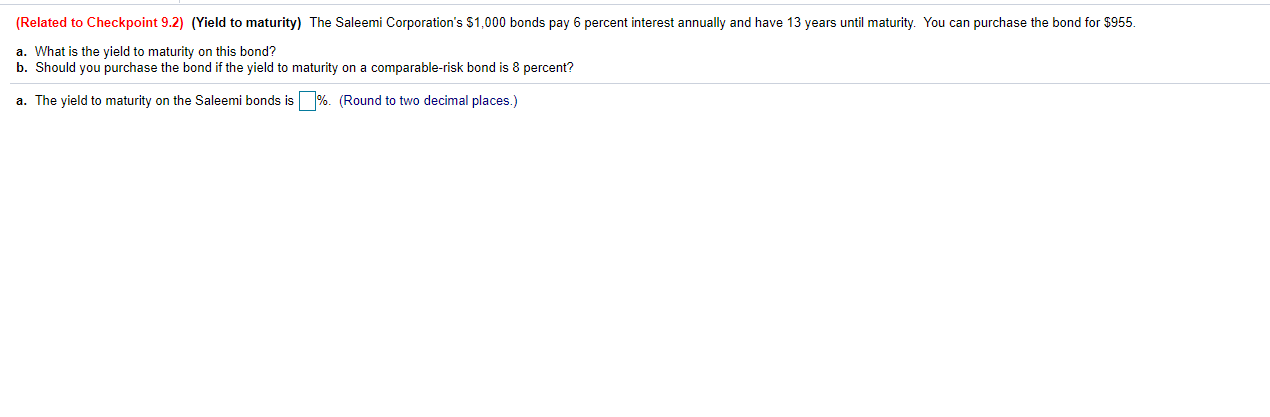

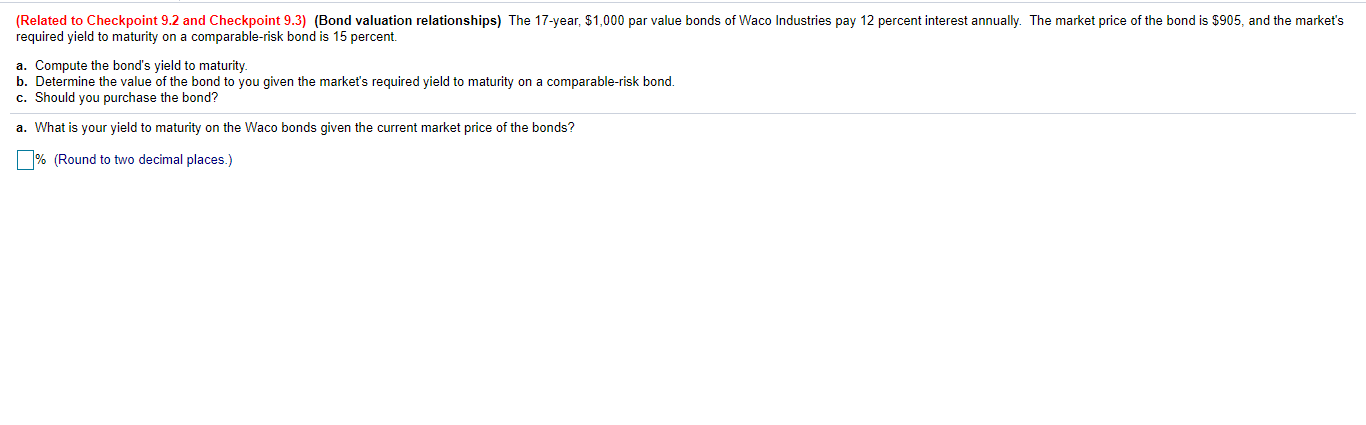

(Related to Checkpoint 9.2) (Yield to maturity) The Saleemi Corporation's $1,000 bonds pay 6 percent interest annually and have 13 years until maturity. You can purchase the bond for $955. a. What is the yield to maturity on this bond? b. Should you purchase the bond if the yield to maturity on a comparable-risk bond is 8 percent? a. The yield to maturity on the Saleemi bonds is %. (Round to two decimal places.) (Related to Checkpoint 9.2 and Checkpoint 9.3) (Bond valuation relationships) The 17-year, $1,000 par value bonds of Waco Industries pay 12 percent interest annually. The market price of the bond is $905, and the market's required yield to maturity on a comparable-risk bond is 15 percent. a. Compute the bond's yield to maturity b. Determine the value of the bond to you given the market's required yield to maturity on a comparable-risk bond. c. Should you purchase the bond? a. What is your yield to maturity on the Waco bonds given the current market price of the bonds? % (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts