Question: COULD YOU ALSO PROVIDE A SPREADSHEET EXAMPLE. IT HELPS ME IN MY STUDY AND UNDERSTANDING OF THE SOULTION. THANKS 7. Assume that the Mexican peso

COULD YOU ALSO PROVIDE A SPREADSHEET EXAMPLE. IT HELPS ME IN MY STUDY AND UNDERSTANDING OF THE SOULTION. THANKS

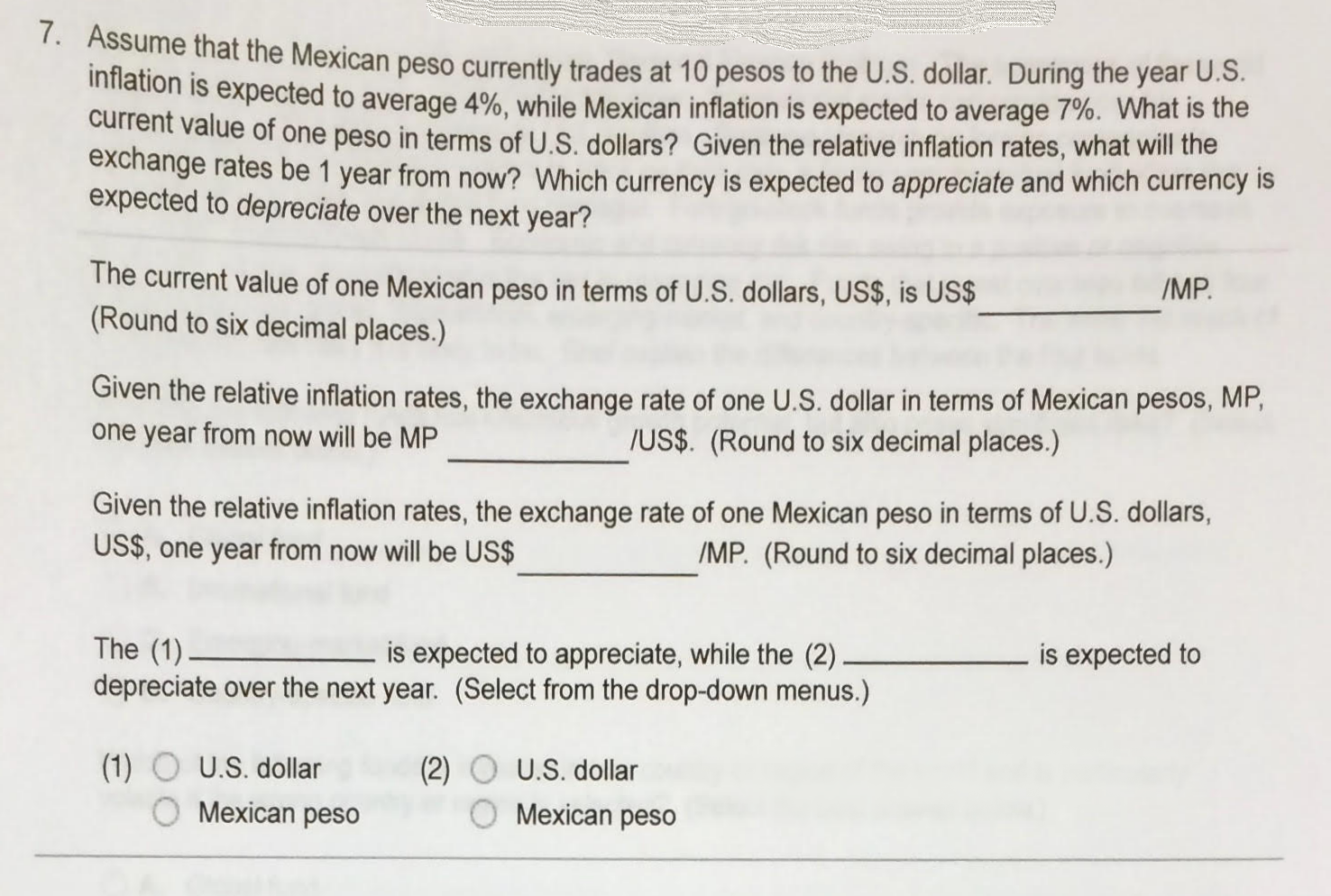

7. Assume that the Mexican peso currently trades at 10 pesos to the U.S. dollar. During the year U.S. inflation is expected to average 4%, while Mexican inflation is expected to average 7%. What is the current value of one peso in terms of U.S. dollars? Given the relative inflation rates, what will the exchange rates be 1 year from now? Which currency is expected to appreciate and which currency is expected to depreciate over the next year? The current value of one Mexican peso in terms of U.S. dollars, US$, is US$ (Round to six decimal places.) /MP. Given the relative inflation rates, the exchange rate of one U.S. dollar in terms of Mexican pesos, MP, one year from now will be MP JUS$. (Round to six decimal places.) Given the relative inflation rates, the exchange rate of one Mexican peso in terms of U.S. dollars, US$, one year from now will be US$ /MP. (Round to six decimal places.) The (1). is expected to appreciate, while the (2) depreciate over the next year. (Select from the drop-down menus.) is expected to (1) (2) U.S. dollar U.S. dollar Mexican peso Mexican peso

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts