Question: could you answer part (a) (c) (d)? QUESTION 3 ANSWER ALL PARTS OF THIS QUESTION a. Wonderland Entertainment is currently a fully equity funded company

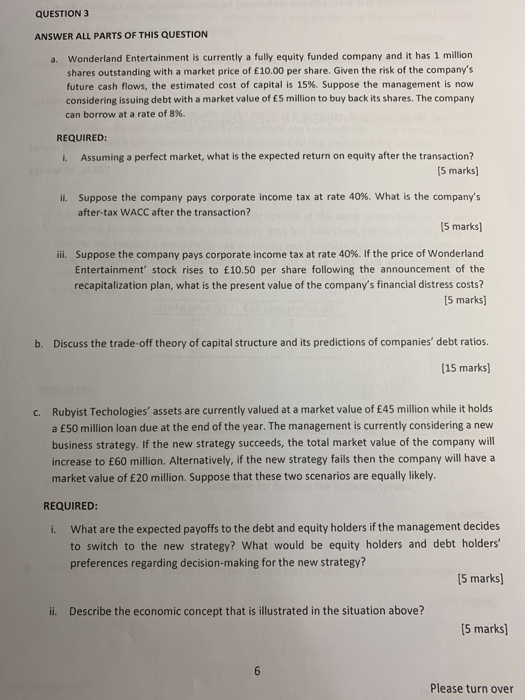

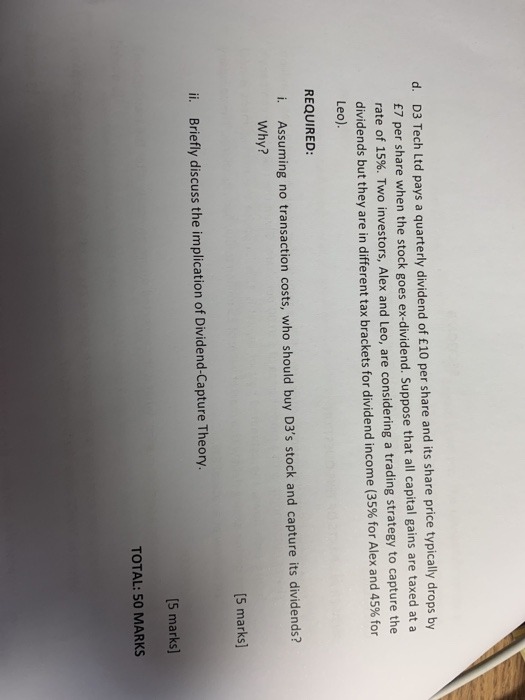

QUESTION 3 ANSWER ALL PARTS OF THIS QUESTION a. Wonderland Entertainment is currently a fully equity funded company and it has 1 million shares outstanding with a market price of 10.00 per share. Given the risk of the company's future cash flows, the estimated cost of capital is 15%. Suppose the management is now considering issuing debt with a market value of 5 million to buy back its shares. The company can borrow at a rate of 8%. REQUIRED: Assuming a perfect market, what is the expected return on equity after the transaction? 15 marks) ii. Suppose the company pays corporate income tax at rate 40%. What is the company's after-tax WACC after the transaction? (5 marks] ill. Suppose the company pays corporate income tax at rate 40%. If the price of Wonderland Entertainment stock rises to 10.50 per share following the announcement of the recapitalization plan, what is the present value of the company's financial distress costs? 15 marks] b. Discuss the trade-off theory of capital structure and its predictions of companies' debt ratios. (15 marks] C. Rubyist Techologies' assets are currently valued at a market value of 45 million while it holds a 50 million loan due at the end of the year. The management is currently considering a new business strategy. If the new strategy succeeds, the total market value of the company will increase to 60 million. Alternatively, if the new strategy fails then the company will have a market value of 20 million. Suppose that these two scenarios are equally likely. REQUIRED: 1. What are the expected payoffs to the debt and equity holders if the management decides to switch to the new strategy? What would be equity holders and debt holders' preferences regarding decision-making for the new strategy? (5 marks) ii. Describe the economic concept that is illustrated in the situation above? (5 marks] Please turn over d. D3 Tech Ltd pays a quarterly dividend of 10 per share and its share price typically drops by 7 per share when the stock goes ex-dividend. Suppose that all capital gains are taxed at a rate of 15%. Two investors, Alex and Leo, are considering a trading strategy to capture the dividends but they are in different tax brackets for dividend income (35% for Alex and 45% for Leo). REQUIRED: i. Assuming no transaction costs, who should buy D3's stock and capture its dividends? Why? [5 marks] il. Briefly discuss the implication of Dividend-Capture Theory. (5 marks] TOTAL: 50 MARKS QUESTION 3 ANSWER ALL PARTS OF THIS QUESTION a. Wonderland Entertainment is currently a fully equity funded company and it has 1 million shares outstanding with a market price of 10.00 per share. Given the risk of the company's future cash flows, the estimated cost of capital is 15%. Suppose the management is now considering issuing debt with a market value of 5 million to buy back its shares. The company can borrow at a rate of 8%. REQUIRED: Assuming a perfect market, what is the expected return on equity after the transaction? 15 marks) ii. Suppose the company pays corporate income tax at rate 40%. What is the company's after-tax WACC after the transaction? (5 marks] ill. Suppose the company pays corporate income tax at rate 40%. If the price of Wonderland Entertainment stock rises to 10.50 per share following the announcement of the recapitalization plan, what is the present value of the company's financial distress costs? 15 marks] b. Discuss the trade-off theory of capital structure and its predictions of companies' debt ratios. (15 marks] C. Rubyist Techologies' assets are currently valued at a market value of 45 million while it holds a 50 million loan due at the end of the year. The management is currently considering a new business strategy. If the new strategy succeeds, the total market value of the company will increase to 60 million. Alternatively, if the new strategy fails then the company will have a market value of 20 million. Suppose that these two scenarios are equally likely. REQUIRED: 1. What are the expected payoffs to the debt and equity holders if the management decides to switch to the new strategy? What would be equity holders and debt holders' preferences regarding decision-making for the new strategy? (5 marks) ii. Describe the economic concept that is illustrated in the situation above? (5 marks] Please turn over d. D3 Tech Ltd pays a quarterly dividend of 10 per share and its share price typically drops by 7 per share when the stock goes ex-dividend. Suppose that all capital gains are taxed at a rate of 15%. Two investors, Alex and Leo, are considering a trading strategy to capture the dividends but they are in different tax brackets for dividend income (35% for Alex and 45% for Leo). REQUIRED: i. Assuming no transaction costs, who should buy D3's stock and capture its dividends? Why? [5 marks] il. Briefly discuss the implication of Dividend-Capture Theory. (5 marks] TOTAL: 50 MARKS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts