Question: could you answer the entire problem based on this journal entry?.Actually sent you a picture of it. Valley Realty acts as an agent in buying,

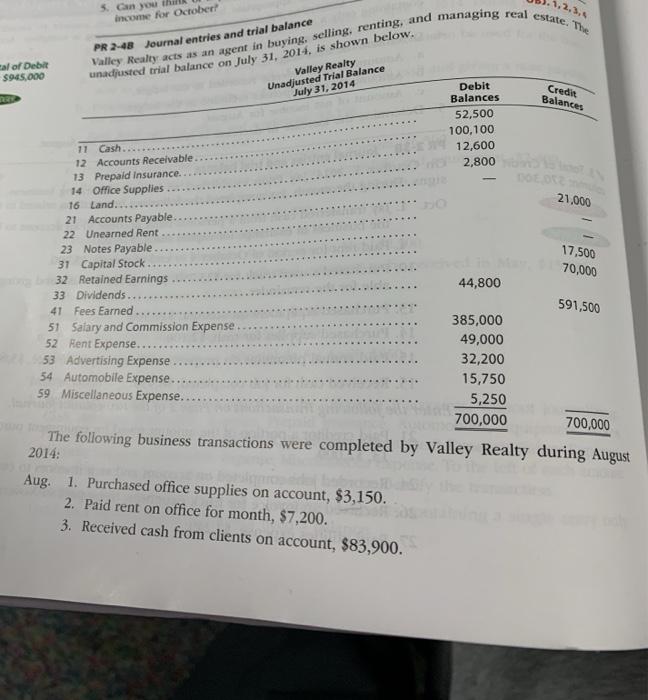

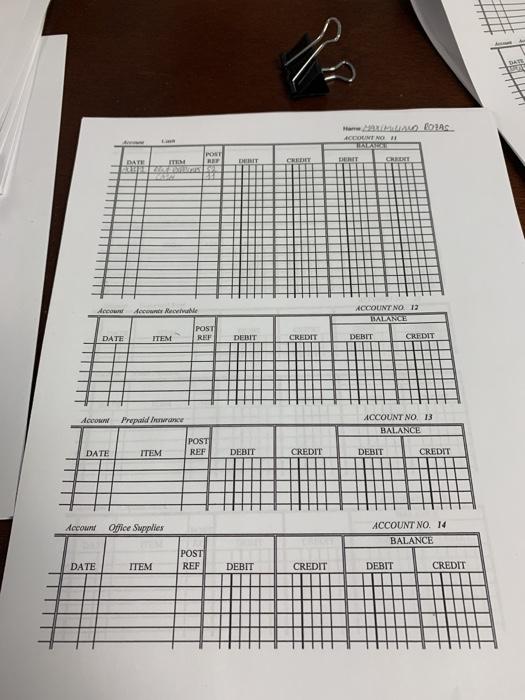

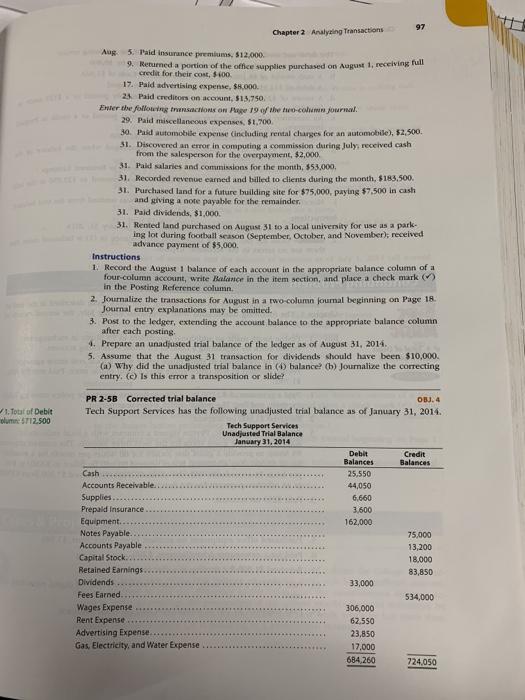

Valley Realty acts as an agent in buying, selling, renting, and managing real estate. The 5. Can you 1,2,3,4 income for October PR2-48 Journal entries and trial balance 31is shown below. Valley Realty Unadjusted Trial Balance July 31, 2014 Credin Balances 21.000 17,500 70,000 al of Debt $945.000 Debit Balances 52,500 100,100 11 Cash 12,600 12 Accounts Receivable 2,800 13 Prepaid Insurance. 14 Office Supplies 16 Land... 21 Accounts Payable 22 Unearned Rent 23 Notes Payable 31 Capital Stock 32 Retained Earnings 44,800 33 Dividends.. 41 Fees Earned. 51 Salary and Commission Expense 385,000 52 Rent Expense..... 49,000 53 Advertising Expense 32,200 54 Automobile Expense.. 15,750 59 Miscellaneous Expense.. 5,250 700,000 700,000 The following business transactions were completed by Valley Realty during August 2014: Aug. 1. Purchased office supplies on account, $3,150. 2. Paid rent on office for month, $7,200. 3. Received cash from clients on account, $83,900. 591,500 Marc BOLAS ACCOUNT NO CRE CENT 27 RAT ZEMELE de che ACCOUNT NO. 12 BALANCE POST REF DATE ITEM DEBIT CREDIT DEBIT CREDIT doc Prepaid we ACCOUNT NO 13 BALANCE POST REF DATE ITEM DEBIT CREDIT DEBIT CREDIT decor Office Supplies ACCOUNT NO. 14 BALANCE POST REF DATE ITEM DEBIT CREDIT DEBIT CREDIT 97 Chapter 2 Analyzing Transactions Aug 5. Paid Insurance premiums, $12.000 9. Returned a portion of the office supplies purchased on August 1, receiving full credit for their cost $100 17. Paid advertising expense, $8.000. 2% Paid creditors on account, $13.750 Enter the following innsactions on age 19 of the two-column journal 29. Paid miscellaneous expenses, $1.700 30. Pald automobile expense (including rental charges for an automobile), $2,500. 31. Discovered an error in computing a commission during July, received cash from the salesperson for the overpayment, $2,000 31. Paid salaries and commissions for the month, 853.000 31. Recorded revenbe earned and billed to clients during the month $183,500. 31. Purchased land for a future building site for $75,000, paying $7,500 in cash and giving a note payable for the remainder 31. Paid dividends, $1,000 31. Rented land purchased on August 31 to a local university for use as a park ing lot during football season (September October, and November)received advance payment of $5,000. Instructions 1. Record the August 1 balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark in the Posting Reference column 2. Journalize the transactions for August in a two column Journal beginning on Page 18 Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting 4. Prepare an unadjusted trial balance of the ledger as of August 31, 2014 5. Assume that the August 31 transaction for dividends should have been $10,000 (a) Why did the unadjusted trial balance in balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide? 1.Totat of Debit olume 5712.500 PR 2-5B Corrected trial balance OBJ. 4 Tech Support Services has the following unadjusted trial balance as of January 31, 2014 Tech Support Services Unadjusted Trial Balance January 31, 2014 Debit Credit Balances Balances Cash 25,550 Accounts Receivable 44,050 Supplies 6,660 Prepaid Insurance 3,600 Equipment 162,000 Notes Payable 75,000 Accounts Payable 13,200 Capital Stock... 18.000 Retained Earnings 83,850 Dividends 33,000 Fees Earned 534,000 Wages Expense 306,000 Rent Expense 62.550 Advertising Expense. 23,850 Gas, Electricity, and Water Expense 17.000 684 260 724,050

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts