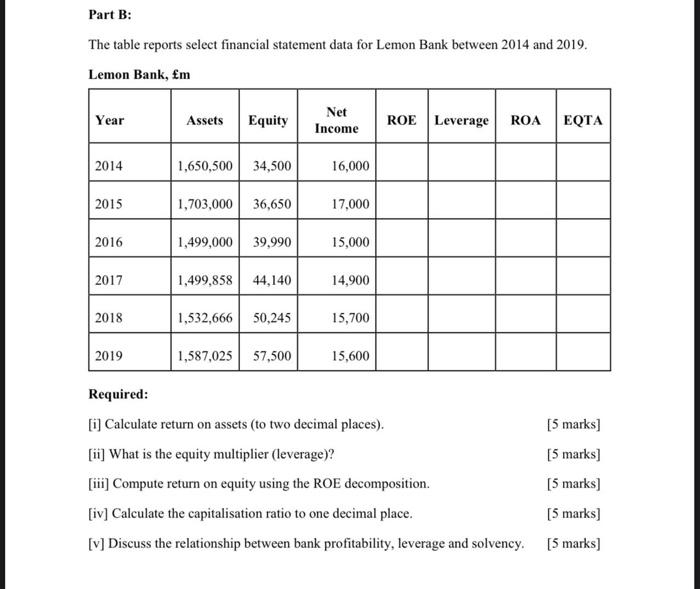

Question: could you answer the question please ? The table reports select financial statement data for Lemon Bank between 2014 and 2019. Lemon Bank, fm Required:

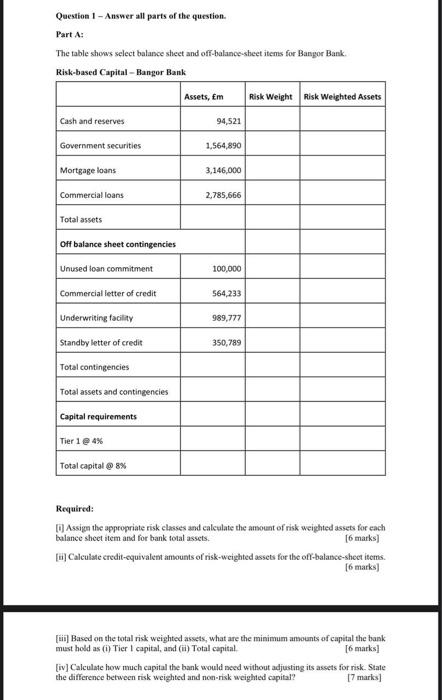

The table reports select financial statement data for Lemon Bank between 2014 and 2019. Lemon Bank, fm Required: [i] Calculate return on assets (to two decimal places). [5 marks] [ii] What is the equity multiplier (leverage)? [5 marks] [iii] Compute return on equity using the ROE decomposition. [5 marks] [iv] Calculate the capitalisation ratio to one decimal place. [5 marks] [v] Discuss the relationship between bank profitability, leverage and solvency. [5 marks] Question 1 - Answer all parts of the question. Part A: The table shows select balance sheet and off-balancessheet items for Bangor Bank. Requirce: [i] Assiga the appropriate risk classes and calculate the amount of risk weighted assets for each balance sheet item and for bank total assets. [6 marks] [ii] Calculate credit-equivalent amounts of risk-weighted assets for tbe off-balance-sheet items. [6 marks] [iii] Based on the total risk weighted assets, what are the minimum anounts of capital the bank must hold as (i) Tier I capital, and (ii) Total cepital. [6 marks] [iv] Calculate how much capital the bank would need without adjusting its assets for risk. State the difference between risk weighted and non-risk weighted capital? [7 marks] The table reports select financial statement data for Lemon Bank between 2014 and 2019. Lemon Bank, fm Required: [i] Calculate return on assets (to two decimal places). [5 marks] [ii] What is the equity multiplier (leverage)? [5 marks] [iii] Compute return on equity using the ROE decomposition. [5 marks] [iv] Calculate the capitalisation ratio to one decimal place. [5 marks] [v] Discuss the relationship between bank profitability, leverage and solvency. [5 marks] Question 1 - Answer all parts of the question. Part A: The table shows select balance sheet and off-balancessheet items for Bangor Bank. Requirce: [i] Assiga the appropriate risk classes and calculate the amount of risk weighted assets for each balance sheet item and for bank total assets. [6 marks] [ii] Calculate credit-equivalent amounts of risk-weighted assets for tbe off-balance-sheet items. [6 marks] [iii] Based on the total risk weighted assets, what are the minimum anounts of capital the bank must hold as (i) Tier I capital, and (ii) Total cepital. [6 marks] [iv] Calculate how much capital the bank would need without adjusting its assets for risk. State the difference between risk weighted and non-risk weighted capital? [7 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts