Question: Could you clearly explain question (c), (d), (e) for me?? Thanks!!!!!!!! Risk and Return The information below is used to answer the next three questions.

Could you clearly explain question (c), (d), (e) for me?? Thanks!!!!!!!!

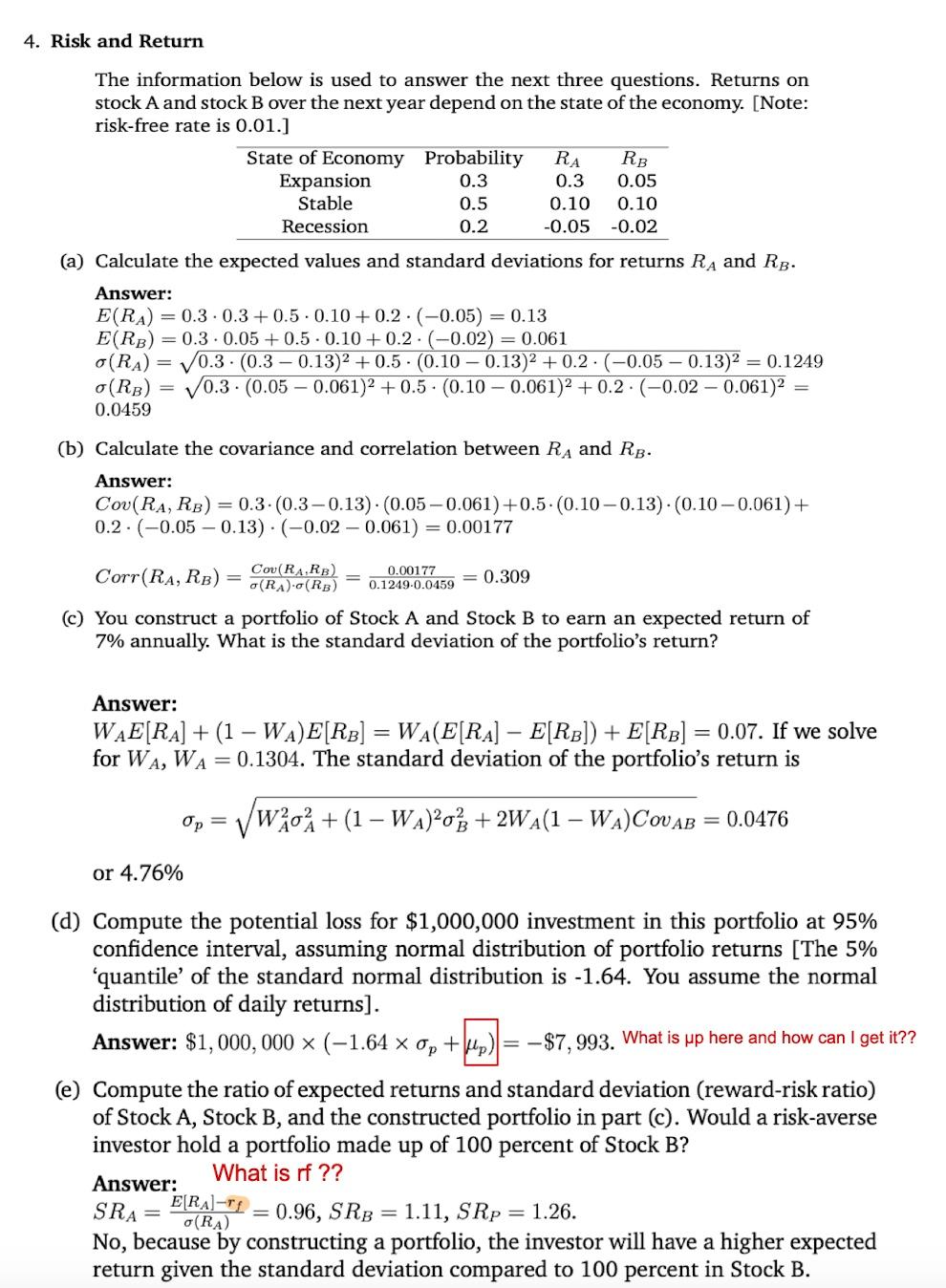

Risk and Return The information below is used to answer the next three questions. Returns on stock A and stock B over the next year depend on the state of the economy. [Note: risk-free rate is 0.01. (a) Calculate the expected values and standard deviations for returns RA and RB. Answer: E(RA)=0.30.3+0.50.10+0.2(0.05)=0.13E(RB)=0.30.05+0.50.10+0.2(0.02)=0.061(RA)=0.3(0.30.13)2+0.5(0.100.13)2+0.2(0.050.13)2=0.1249(RB)=0.3(0.050.061)2+0.5(0.100.061)2+0.2(0.020.061)2=0.0459 (b) Calculate the covariance and correlation between RA and RB. Answer: Cov(RA,RB)=0.3(0.30.13)(0.050.061)+0.5(0.100.13)(0.100.061)+0.2(0.050.13)(0.020.061)=0.00177Corr(RA,RB)=(RA)(RB)Cov(RA,RB)=0.12490.04590.00177=0.309 (c) You construct a portfolio of Stock A and Stock B to earn an expected return of 7% annually. What is the standard deviation of the portfolio's return? Answer: WAE[RA]+(1WA)E[RB]=WA(E[RA]E[RB])+E[RB]=0.07. If we solve for WA,WA=0.1304. The standard deviation of the portfolio's return is p=WA2A2+(1WA)2B2+2WA(1WA)CovAB=0.0476 or 4.76% (d) Compute the potential loss for $1,000,000 investment in this portfolio at 95% confidence interval, assuming normal distribution of portfolio returns [The 5% 'quantile' of the standard normal distribution is -1.64. You assume the normal distribution of daily returns]. Answer: $1,000,000(1.64p+p)=$7,993. What is p here and how can I get it?? (e) Compute the ratio of expected returns and standard deviation (reward-risk ratio) of Stock A, Stock B, and the constructed portfolio in part (c). Would a risk-averse investor hold a portfolio made up of 100 percent of Stock B? Answer: What is if ?? SRA=(RA)E[RA]rf=0.96,SRB=1.11,SRP=1.26. No, because by constructing a portfolio, the investor will have a higher expected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts