Question: Could you explain me how to get the answer step by step. Gord earns $500.00 per week. This pay period he receives a bonus of

Could you explain me how to get the answer step by step.

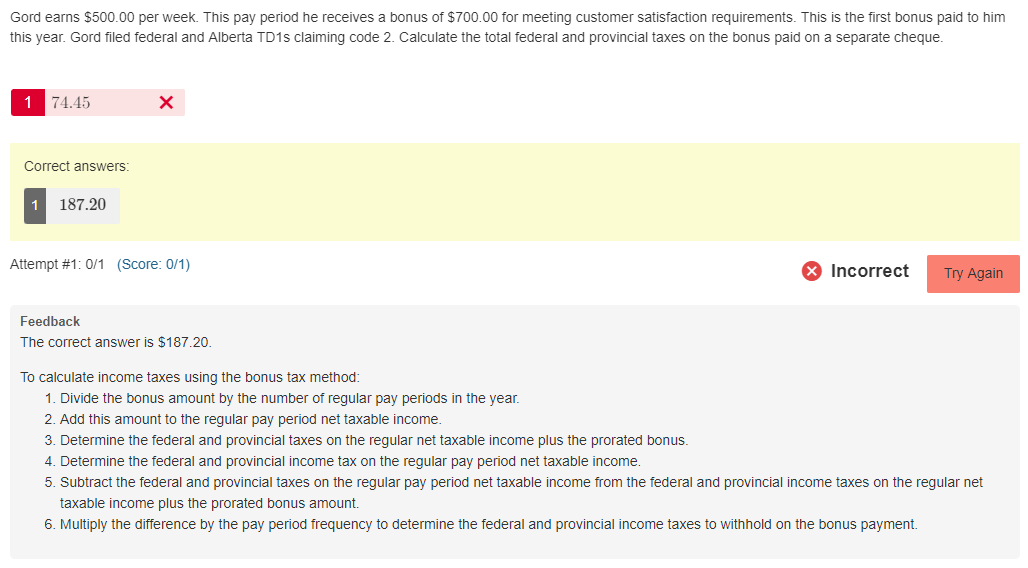

Gord earns $500.00 per week. This pay period he receives a bonus of $700.00 for meeting customer satisfaction requirements. This is the first bonus paid to him this year. Gord filed federal and Alberta TD1s claiming code 2. Calculate the total federal and provincial taxes on the bonus paid on a separate cheque. Correct answers: Attempt \#1: 0/1 (Score: 0/1) X Incorrect Feedback The correct answer is $187.20. To calculate income taxes using the bonus tax method: 1. Divide the bonus amount by the number of regular pay periods in the year. 2. Add this amount to the regular pay period net taxable income. 3. Determine the federal and provincial taxes on the regular net taxable income plus the prorated bonus. 4. Determine the federal and provincial income tax on the regular pay period net taxable income. 5. Subtract the federal and provincial taxes on the regular pay period net taxable income from the federal and provincial income taxes on the regular net taxable income plus the prorated bonus amount. 6. Multiply the difference by the pay period frequency to determine the federal and provincial income taxes to withhold on the bonus payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts