Question: Could you explain problem #12-13 please Problem #12 An apartment building with an adjusted basis of $500,000 was destroyed by a tornado on April 30,

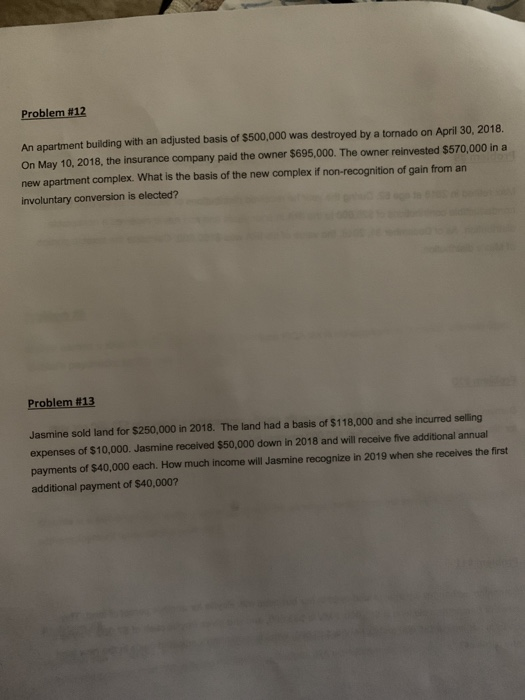

Problem #12 An apartment building with an adjusted basis of $500,000 was destroyed by a tornado on April 30, 2018, On May 10, 2018, the insurance company paid the owner $695,000. The owner reinvested $570,000 in a new apartment complex. What is the basis of the new complex if non-recognition of gain from an involuntary conversion is elected? Problem #13 Jasmine sold land for $250,000 in 2018. The land had a basis of $118,000 and she incurred selling expenses of $10,000. Jasmine received $50,000 down in 2018 and will receive five additional annual payments of $40,000 each. How much income will Jasmine recognize in 2019 when she receives the first additional payment of $40,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts