Question: Could you explain step by step thx 9) The Mateo Corporation's inventory at December 31, 2016 considering the following: , had a cost of $400,000based

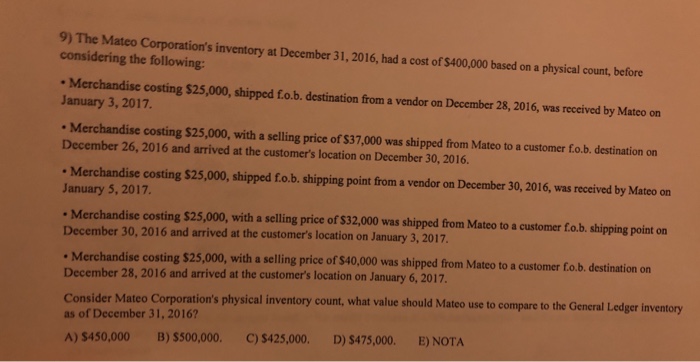

9) The Mateo Corporation's inventory at December 31, 2016 considering the following: , had a cost of $400,000based on a physical count, before Merchandise costing $25,000, shipped f.o.b. destination from a vendor on December 28, 2016, was received by Mateo orn January 3, 2017. Merchandise costing $25,000, with a selling price of $37,000 was shipped from Mateo to a customer f.o.b. destination on December 26, 2016 and arrived at the customer's location on December 30, 2016. Merchandise costing $25,000, shipped f.o.b. shipping point from a vendor on December 30, 2016, was received by Mateo on January 5, 2017. Merchandise costing $25,000, with a selling price of $32,000 was shipped from Mateo to a customer fo.b. shipping point on December 30, 2016 and arrived at the customer's location on January 3,2017 . Merchandise costing $25,000, with a selling price of $40,000 was shipped from Mateo to a customer fo.b. destination on December 28, 2016 and arrived at the customer's location on January 6,2017 Consider Mateo Corporation's physical inventory count, what value should Mateo use to compare to the General Ledger inventory as of December 31, 2016? A) $450,000 B) 00,000. C)$425,000. D) $475,000. E) NOTA s of December

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts