Question: Could you explain the exact formulas for PVA and PV? eg. $16*PVA_n=15,i=11%=? $160*PV_n=15,i=11%=? Maturity model sample question Using the following balance sheet for MII Bank

Could you explain the exact formulas for PVA and PV?

eg. $16*PVA_n=15,i=11%=?

$160*PV_n=15,i=11%=?

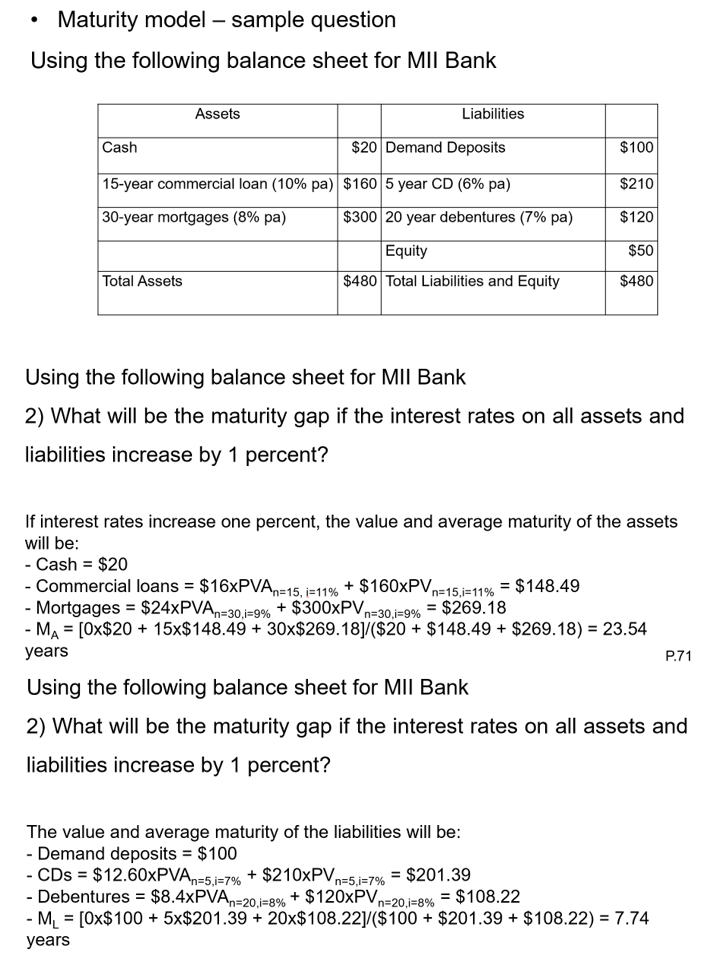

Maturity model sample question Using the following balance sheet for MII Bank Assets Liabilities Cash $20 Demand Deposits $100 15-year commercial loan (10% pa) $160 5 year CD (6% pa) $210 30-year mortgages (8% pa) $300 20 year debentures (7% pa) $120 $50 Equity $480 Total Liabilities and Equity Total Assets $480 Using the following balance sheet for MII Bank 2) What will be the maturity gap if the interest rates on all assets and liabilities increase by 1 percent? n=15. 11% = $148.49 = n n=30,i=9% = If interest rates increase one percent, the value and average maturity of the assets will be: - Cash = $20 - Commercial loans = $16xPVAn=15, i=11% + $160xPV, - Mortgages = $24xPVA=30,39% + $300xPV, = $269.18 - MA = [Ox$20 + 15x$148.49 + 30x$269.18]/($20 + $148.49 + $269.18) = 23.54 years P.71 Using the following balance sheet for MII Bank 2) What will be the maturity gap if the interest rates on all assets and liabilities increase by 1 percent? The value and average maturity of the liabilities will be: - Demand deposits = $100 - CDs = $12.60xPVAn=5.1=7% + $210xPV) - Debentures = $8.4xPVAn=20,i=8% + $120xPV, = $108.22 - ML = [Ox$100 + 5x$201.39 + 20x$108.22]/($100 + $201.39 + $108.22) = 7.74 years n=5,i=7% = $201.39 =, n=20,i=8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts