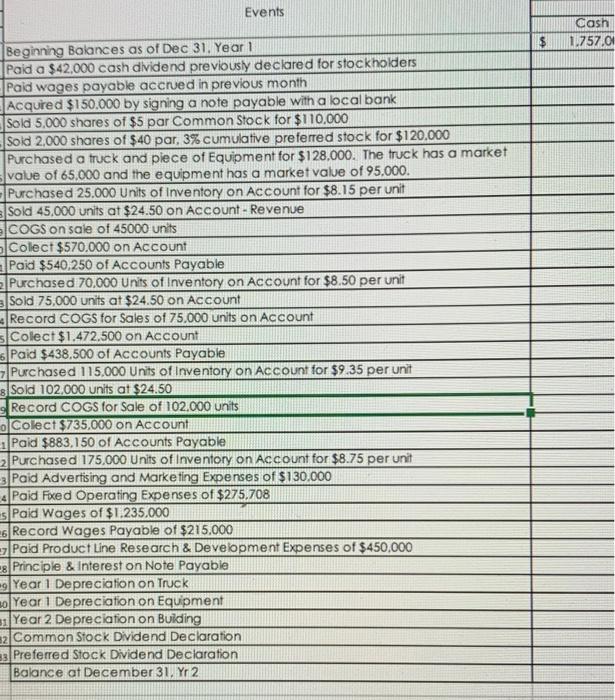

Question: Could you fill out the pro forma statement usingbthis information please!! thanks so much Events Cash 1.757.01 $ Beginning Balances as of Dec 31, Year

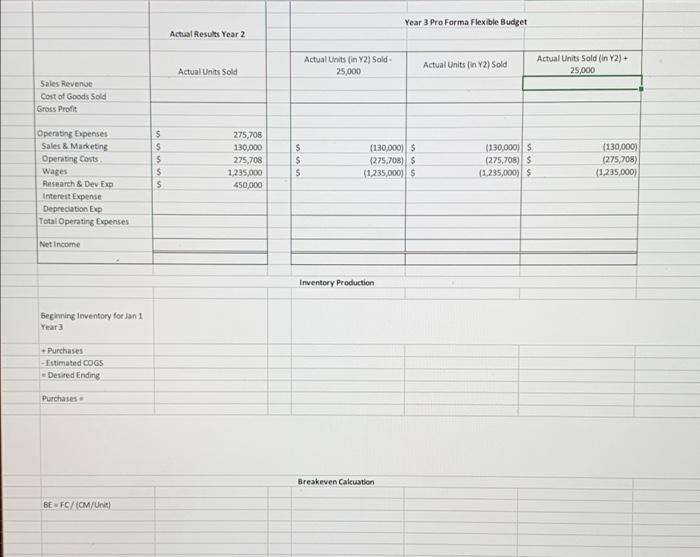

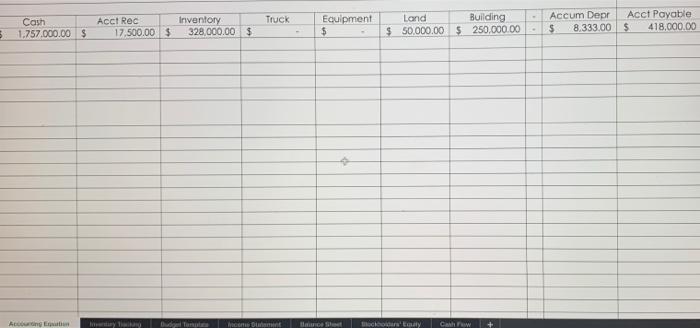

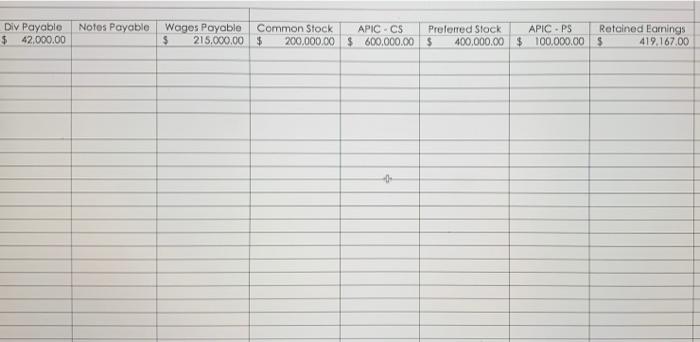

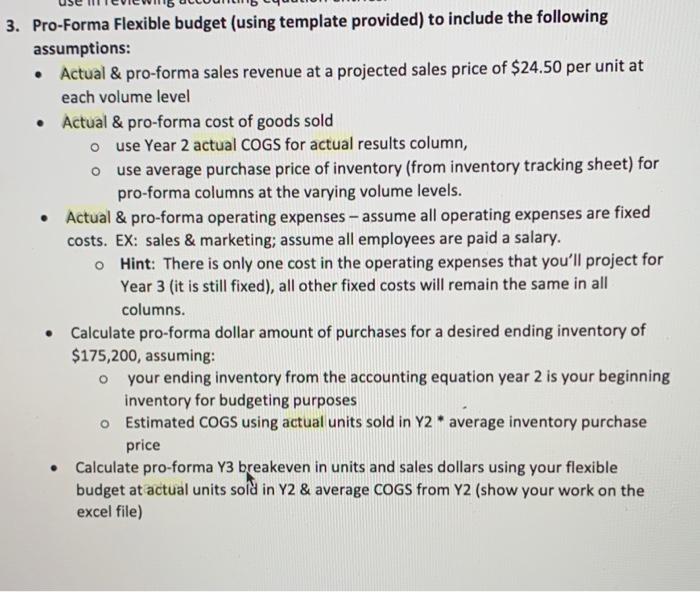

Events Cash 1.757.01 $ Beginning Balances as of Dec 31, Year 1 Paid a $42.000 cash dividend previously declared for stockholders Paid wages payable accrued in previous month Acquired $150.000 by signing a note payable with a local bank Sold 5,000 shares of $5 par Common Stock for $110,000 Sold 2,000 shares of $40 par, 3% cumulative preferred stock for $120.000 Purchased a truck and piece of Equipment for $128.000. The truck has a market value of 65.000 and the equipment has a market value of 95.000. Purchased 25.000 units of Inventory on Account for $8.15 per unit Sold 45,000 units at $24.50 on Account - Revenue COGS on sale of 45000 units Colect $570.000 on Account Paid $540,250 of Accounts Payable Purchased 70.000 units of Inventory on Account for $8.50 per unit Sold 75,000 units at $24.50 on Account Record COGS for Sales of 75.000 units on Account s Colect $1.472.500 on Account 6 Paid $438.500 of Accounts Payable Purchased 115.000 Units of Inventory on Account for $9.35 per unit 8 Sold 102.000 units at $24.50 Record COGS for Sale of 102.000 units o Colect $735,000 on Account 1 Paid $883,150 of Accounts Payable 2 Purchased 175,000 units of Inventory on Account for $8.75 per unit Paid Advertising and Marketing Expenses of $130.000 Paid Fixed Operating Expenses of $275.708 s Paid Wages of $1.235.000 6 Record Wages Payable of $215.000 Paid Product Line Research & Development Expenses of $450.000 8 Principle & Interest on Note Payable 9 Year 1 Depreciation on Truck 20 Year 1 Depreciation on Equipment 1 Year 2 Depreciation on Buiding 22 Common Stock Dividend Declaration 33 Preferred Stock Dividend Declaration Balance at December 31, Yr 2 Year 3 Pro Forma Flexible Budget Actual Results Year 2 Actual Units in Y2) Sold 25,000 Actual Units (in Y2) Sold Actual Units Sold (in Y2). 25,000 Actual Units Sold Sales Revenue Cost of Goods Sold Gross Profit $ $ $ $ Operating Expenses Sales & Marketing Operating costs Wages Research & Dev Exp Interest Expense Depreciation Exp Total Operating Expenses 275,708 130,000 275,708 1.235,000 450,000 $ S (130,000) (275,708) $ (1.235.000) (130,000) (275,708) (1.235,000) (130,000) 1275,708) (1.235,000) Net Income Inventory Production beginning inventory for Jan 1 Year - Purchases Estimated COGS -Desired Ending Purchases Breakeven Calcuation BEFC/CM/Unit) Truck Cash 1.757.000.00 $ Acct Rec Inventory 17,500.00 $ 328,000.00 $ Equipment $ Land Building $ 50,000.00 $ 250,000.00 Accum Depr Acct Payable $ 8.333.00 $ 418,000.00 5 ya ID sheart corty Notes Payable Div Payable $ 42,000.00 Wages Payablo Common Stock APIC - CS Preferred Stock APIC - PS Retained Eomings $ 215,000.00 $ 200,000.00 $ 600,000.00 $ 400,000.00 $ 100,000.00 $ 419.167.00 0 . 3. Pro-Forma Flexible budget (using template provided) to include the following assumptions: Actual & pro-forma sales revenue at a projected sales price of $24.50 per unit at each volume level Actual & pro-forma cost of goods sold o use Year 2 actual COGS for actual results column, o use average purchase price of inventory (from inventory tracking sheet) for pro-forma columns at the varying volume levels. Actual & pro-forma operating expenses - assume all operating expenses are fixed costs. Ex: sales & marketing; assume all employees are paid a salary. o Hint: There is only one cost in the operating expenses that you'll project for Year 3 (it is still fixed), all other fixed costs will remain the same in all columns. Calculate pro-forma dollar amount of purchases for a desired ending inventory of $175,200, assuming: o your ending inventory from the accounting equation year 2 is your beginning inventory for budgeting purposes o Estimated COGS using actual units sold in Y2 average inventory purchase price Calculate pro-forma Y3 breakeven in units and sales dollars using your flexible budget at actual units sold in Y2 & average COGS from Y2 (show your work on the excel file) Events Cash 1.757.01 $ Beginning Balances as of Dec 31, Year 1 Paid a $42.000 cash dividend previously declared for stockholders Paid wages payable accrued in previous month Acquired $150.000 by signing a note payable with a local bank Sold 5,000 shares of $5 par Common Stock for $110,000 Sold 2,000 shares of $40 par, 3% cumulative preferred stock for $120.000 Purchased a truck and piece of Equipment for $128.000. The truck has a market value of 65.000 and the equipment has a market value of 95.000. Purchased 25.000 units of Inventory on Account for $8.15 per unit Sold 45,000 units at $24.50 on Account - Revenue COGS on sale of 45000 units Colect $570.000 on Account Paid $540,250 of Accounts Payable Purchased 70.000 units of Inventory on Account for $8.50 per unit Sold 75,000 units at $24.50 on Account Record COGS for Sales of 75.000 units on Account s Colect $1.472.500 on Account 6 Paid $438.500 of Accounts Payable Purchased 115.000 Units of Inventory on Account for $9.35 per unit 8 Sold 102.000 units at $24.50 Record COGS for Sale of 102.000 units o Colect $735,000 on Account 1 Paid $883,150 of Accounts Payable 2 Purchased 175,000 units of Inventory on Account for $8.75 per unit Paid Advertising and Marketing Expenses of $130.000 Paid Fixed Operating Expenses of $275.708 s Paid Wages of $1.235.000 6 Record Wages Payable of $215.000 Paid Product Line Research & Development Expenses of $450.000 8 Principle & Interest on Note Payable 9 Year 1 Depreciation on Truck 20 Year 1 Depreciation on Equipment 1 Year 2 Depreciation on Buiding 22 Common Stock Dividend Declaration 33 Preferred Stock Dividend Declaration Balance at December 31, Yr 2 Year 3 Pro Forma Flexible Budget Actual Results Year 2 Actual Units in Y2) Sold 25,000 Actual Units (in Y2) Sold Actual Units Sold (in Y2). 25,000 Actual Units Sold Sales Revenue Cost of Goods Sold Gross Profit $ $ $ $ Operating Expenses Sales & Marketing Operating costs Wages Research & Dev Exp Interest Expense Depreciation Exp Total Operating Expenses 275,708 130,000 275,708 1.235,000 450,000 $ S (130,000) (275,708) $ (1.235.000) (130,000) (275,708) (1.235,000) (130,000) 1275,708) (1.235,000) Net Income Inventory Production beginning inventory for Jan 1 Year - Purchases Estimated COGS -Desired Ending Purchases Breakeven Calcuation BEFC/CM/Unit) Truck Cash 1.757.000.00 $ Acct Rec Inventory 17,500.00 $ 328,000.00 $ Equipment $ Land Building $ 50,000.00 $ 250,000.00 Accum Depr Acct Payable $ 8.333.00 $ 418,000.00 5 ya ID sheart corty Notes Payable Div Payable $ 42,000.00 Wages Payablo Common Stock APIC - CS Preferred Stock APIC - PS Retained Eomings $ 215,000.00 $ 200,000.00 $ 600,000.00 $ 400,000.00 $ 100,000.00 $ 419.167.00 0 . 3. Pro-Forma Flexible budget (using template provided) to include the following assumptions: Actual & pro-forma sales revenue at a projected sales price of $24.50 per unit at each volume level Actual & pro-forma cost of goods sold o use Year 2 actual COGS for actual results column, o use average purchase price of inventory (from inventory tracking sheet) for pro-forma columns at the varying volume levels. Actual & pro-forma operating expenses - assume all operating expenses are fixed costs. Ex: sales & marketing; assume all employees are paid a salary. o Hint: There is only one cost in the operating expenses that you'll project for Year 3 (it is still fixed), all other fixed costs will remain the same in all columns. Calculate pro-forma dollar amount of purchases for a desired ending inventory of $175,200, assuming: o your ending inventory from the accounting equation year 2 is your beginning inventory for budgeting purposes o Estimated COGS using actual units sold in Y2 average inventory purchase price Calculate pro-forma Y3 breakeven in units and sales dollars using your flexible budget at actual units sold in Y2 & average COGS from Y2 (show your work on the excel file)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts