Question: Could you give me the only answer, please? Problem 4-28 Valuing a business Permlan Partners (PP) produces from aging oil fields In west Texas. Production

Could you give me the only answer, please?

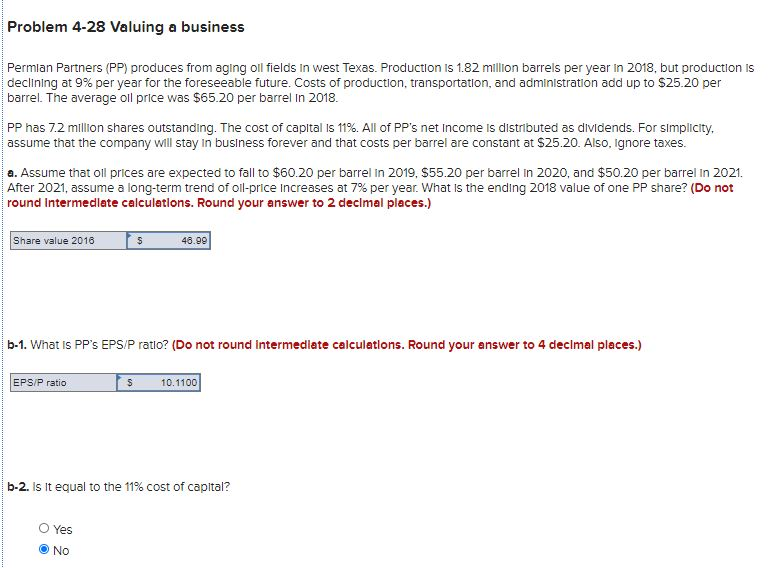

Problem 4-28 Valuing a business Permlan Partners (PP) produces from aging oil fields In west Texas. Production is 1.82 million barrels per year in 2018, but production is declining at 9% per year for the foreseeable future. Costs of production, transportation, and administration add up to $25.20 per barrel. The average oil price was $65.20 per barrel in 2018. PP has 7.2 million shares outstanding. The cost of capital is 11%. All of PP's net Income is distributed as dividends. For simplicity, assume that the company will stay in business forever and that costs per barrel are constant at $25.20. Also, ignore taxes. a. Assume that oil prices are expected to fall to $60.20 per barrel in 2019, $55.20 per barrel in 2020, and $50.20 per barrel in 2021. After 2021, assume a long-term trend of oil-price increases at 7% per year. What is the ending 2018 value of one PP share? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Share value 2016 $ 46.99 b-1. What is PP's EPS/P ratlo? (Do not round Intermediate calculations. Round your answer to 4 decimal places.) EPS/P ratio $ 10.1100 b-2. Is it equal to the 11% cost of capital? Yes No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts