Question: Could you help me answer these, please? (3) Review Note 5 required you to test the operating effectiveness of an internal control (ensuring appropriate approval

Could you help me answer these, please?

(3) Review Note 5 required you to test the operating effectiveness of an internal control (ensuring appropriate approval of

write-offs). To which financial statement assertion does this internal control relate most closely? Based on the evidence

you gathered, and considering the Audit Risk Model, would you recommend that your audit team revise the audit

plan? If so, which risks in the Audit Risk Model would change and how (increase/decrease)? How might you respond

to the changes in these risk(s)?

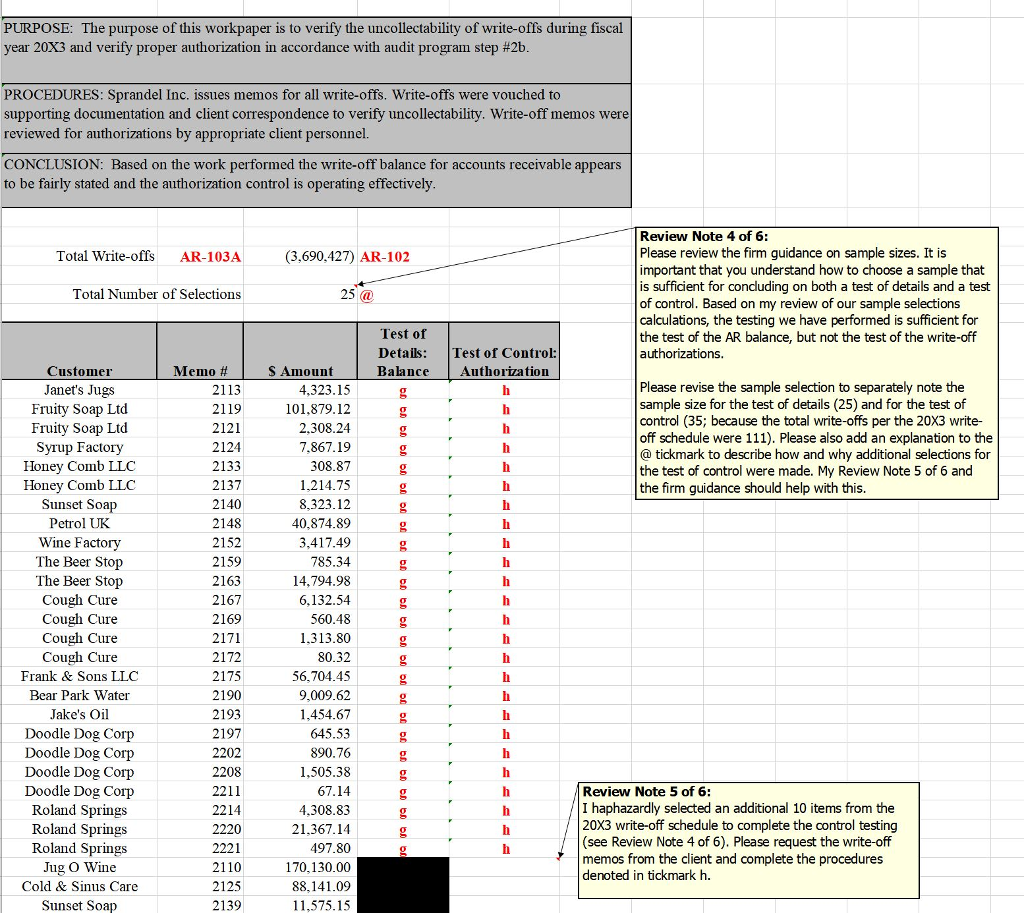

Review Note 5 of 6:

I haphazardly selected an additional 10 items from the 20X3 write-off schedule to complete the control testing (see Review Note 4 of 6). Please request the write-off memos from the client and complete the procedures denoted in tickmark h.

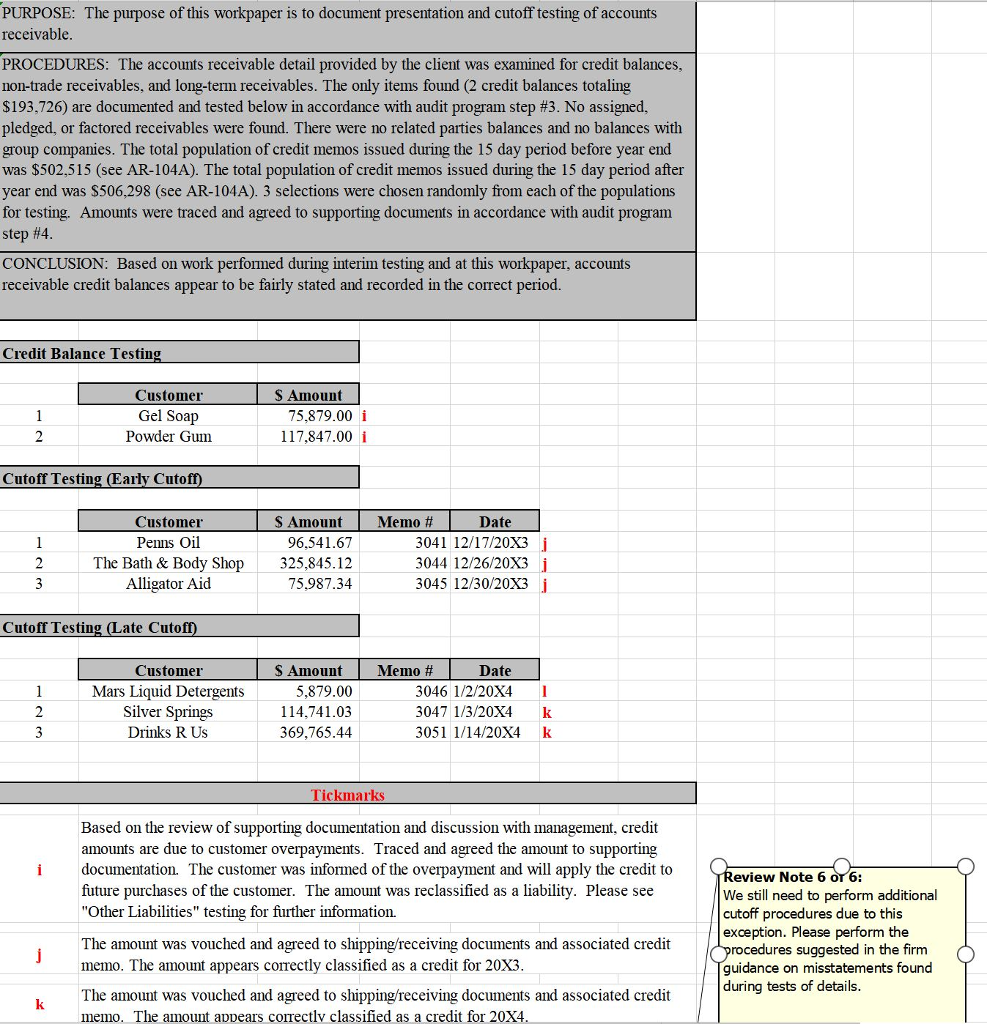

(4) Review Note 6 related to an exception found during cutoff testing and the required additional procedures to be

performed. Based on this exception and the additional procedures you performed, discuss the implications. Consider

the following in your discussion:

a. which financial statement assertion this audit work most closely relates to,

b. the total dollar amount of the exception(s) based on the testing performed,

c. the effect of the exception(s) on the accounts receivable balance (understatement or overstatement) in the current

year (12/31/20X3) and next year (i.e., 12/31/20X4) if not adjusted, and

d. the appropriate auditor response to the exception(s).

Review Note 6 of 6:

We still need to perform additional cutoff procedures due to this exception. Please perform the procedures suggested in the firm guidance on misstatements found during tests of details.

(5) Using PCAOB AS 1215, paragraphs 8 and 12, describe the auditor's responsibilities for documenting information

related to significant findings or issues inconsistent with the auditor's conclusions and three factors that would indicate

a finding or issue is significant. Would you deem any of the issues/exceptions that you noted during your audit work to

be significant?

PURPOSE: The purpose of this workpaper is to verify the uncollectability of write-offs during fiscal year 20X3 and verify proper authorization in accordance with audit program step #2b PROCEDURES: Sprandel Inc. issues memos for all write-offs. Write-offs were vouched to supporting documentation and client correspondence to verify uncollectability. Write-off memos were reviewed for authorizations by appropriate client personnel. CONCLUSION: Based on the work performed the write-off balance for accounts receivable appears to be fairly stated and the authorization control is operating effectively Review Note 4 of 6: Please review the firm guidance on sample sizes. It is important that you understand how to choose a sample that is sufficient for concluding on both a test of details and a test of control. Based on my review of our sample selections calculations, the testing we have performed is sufficient for the test of the AR balance, but not the test of the write-off authorizations Total Write-offsAR-103A(3.690.427) AR-102 Total Number of Selections 25 est of Details: Balance Test of Control: Authorization Customer Janet's Jugs Fruity Soap Ltd Fruity Soap Ltd Syrup Factory Honey Comb LLOC Honey Comb LLC Sunset Soap Petrol UK Memo # S Amount 2113 2119 2124 2133 2137 2140 2148 4,323.15 101,879.1:2 2,308.24 7.867.19 308.87 1.214.75 8,323.12 40,874.89 3,417.49 Please revise the sample selection to separately note the sample size for the test of details (25) and for the test of control (35; because the total write-offs per the 20X3 write- off schedule were 111). Please also add an explanation to the @tickmark to describe how and why additional selections for the test of control were made. My Review Note 5 of 6 and the firm guidance should help with this. 2159 2163 2167 The Beer Stop Cough Cure Cough Cure Cough Cure Cough Cure Frank & Sons LLC Bear Park Water Jake's Oil Doodle Dog Corp Doodle Dog Corp Doodle Dog Corp Doodle Dog Corp Roland Springs Roland Springs Roland Springs Jug O Wine Cold & Sinus Care Sunset Soap 14,794.98 6.132.54 560.48 2171 2172 2175 2190 2193 2197 2202 2208 1.313.80 56,704.45 9,009.62 1,454.67 645.53 890.76 1,505.38 Review Note 5 of 6 I haphazardly selected an additional 10 items from the 20X3 write-off schedule to complete the control testing (see Review Note 4 of 6). Please request the write-off memos from the client and complete the procedures denoted in tickmark h. 2214 4.308.83 21,367.14 497.80 170,130.00 2110 2125 88,141 2139 11,575.15 PURPOSE: The purpose of this workpaper is to document presentation and cutoff testing of accounts receivable PROCEDURES: The accounts receivable detail provided by the client was examined for credit balances non-trade receivables, and long-term receivables. The only items found (2 credit balances totaling $193.726) are documented and tested below in accordance with audit program step #3. No assigned. pledged, or factored receivables were found. There were no related parties balances and no balances with group companies. The total population of credit memos issued during the 15 day period before year end was $502,515 (see AR-104A). The total population of credit memos issued during the 15 day period after year end was $506,298 (see AR-104A). 3 selections were chosen randomly from each of the populations for testing. Amounts were traced and agreed to supporting documents in accordance with audit program step #4 CONCLUSION: Based on work performed during interim testing and at this workpaper, accounts receivable credit balances appear to be fairly stated and recorded in the correct period. Credit Balance Testing Customner S Amount Gel Soap Powder Gum 75,879.00 i 117,847.00 i Cutoff Testing (Early Cuto Customer Penns Oil $ Amount | Memo # Date 96,541.617 2 The Bath & Body Shop 325,845.12 75,987.34 304112/17/20X3 3044 12/26/20X3 j 3045 12/30/20X3i Alligator Aid Cutoff Testing (Late Cuto Customer Mars Ligquid Detergents Silver Springs Drinks R Us $ Amount | Memo # Date 5,879.00 114,741.03 369,765.44 3046 1/2/20X4 I 3047 1/3/20X4 k 3051 1/14/20X4 k Tickmarks Based on the review of supporting documentation and discussion with management, credit amounts are due to customer overpayments. Traced and agreed the amount to supporting documentation. The customer was informed of the overpayment and will apply the credit to future purchases of the customer. The amount was reclassified as a liability. Please see "Other Liabilities" testing for further information. i eview Note 6 or 6: We still need to perform additional cutoff procedures due to this exception. Please perform the The amount was vouched and agreed to shipping/receiving documents and associated credit memo. The amount appears correctly classified as a credit for 20X3 The amount was vouched and agreed to shipping/receiving documents and associated credit memo. The amount aopears correctlv classified as a credit for 20X4 rocedures suggested in the firm guidance on misstatements found during tests of details PURPOSE: The purpose of this workpaper is to verify the uncollectability of write-offs during fiscal year 20X3 and verify proper authorization in accordance with audit program step #2b PROCEDURES: Sprandel Inc. issues memos for all write-offs. Write-offs were vouched to supporting documentation and client correspondence to verify uncollectability. Write-off memos were reviewed for authorizations by appropriate client personnel. CONCLUSION: Based on the work performed the write-off balance for accounts receivable appears to be fairly stated and the authorization control is operating effectively Review Note 4 of 6: Please review the firm guidance on sample sizes. It is important that you understand how to choose a sample that is sufficient for concluding on both a test of details and a test of control. Based on my review of our sample selections calculations, the testing we have performed is sufficient for the test of the AR balance, but not the test of the write-off authorizations Total Write-offsAR-103A(3.690.427) AR-102 Total Number of Selections 25 est of Details: Balance Test of Control: Authorization Customer Janet's Jugs Fruity Soap Ltd Fruity Soap Ltd Syrup Factory Honey Comb LLOC Honey Comb LLC Sunset Soap Petrol UK Memo # S Amount 2113 2119 2124 2133 2137 2140 2148 4,323.15 101,879.1:2 2,308.24 7.867.19 308.87 1.214.75 8,323.12 40,874.89 3,417.49 Please revise the sample selection to separately note the sample size for the test of details (25) and for the test of control (35; because the total write-offs per the 20X3 write- off schedule were 111). Please also add an explanation to the @tickmark to describe how and why additional selections for the test of control were made. My Review Note 5 of 6 and the firm guidance should help with this. 2159 2163 2167 The Beer Stop Cough Cure Cough Cure Cough Cure Cough Cure Frank & Sons LLC Bear Park Water Jake's Oil Doodle Dog Corp Doodle Dog Corp Doodle Dog Corp Doodle Dog Corp Roland Springs Roland Springs Roland Springs Jug O Wine Cold & Sinus Care Sunset Soap 14,794.98 6.132.54 560.48 2171 2172 2175 2190 2193 2197 2202 2208 1.313.80 56,704.45 9,009.62 1,454.67 645.53 890.76 1,505.38 Review Note 5 of 6 I haphazardly selected an additional 10 items from the 20X3 write-off schedule to complete the control testing (see Review Note 4 of 6). Please request the write-off memos from the client and complete the procedures denoted in tickmark h. 2214 4.308.83 21,367.14 497.80 170,130.00 2110 2125 88,141 2139 11,575.15 PURPOSE: The purpose of this workpaper is to document presentation and cutoff testing of accounts receivable PROCEDURES: The accounts receivable detail provided by the client was examined for credit balances non-trade receivables, and long-term receivables. The only items found (2 credit balances totaling $193.726) are documented and tested below in accordance with audit program step #3. No assigned. pledged, or factored receivables were found. There were no related parties balances and no balances with group companies. The total population of credit memos issued during the 15 day period before year end was $502,515 (see AR-104A). The total population of credit memos issued during the 15 day period after year end was $506,298 (see AR-104A). 3 selections were chosen randomly from each of the populations for testing. Amounts were traced and agreed to supporting documents in accordance with audit program step #4 CONCLUSION: Based on work performed during interim testing and at this workpaper, accounts receivable credit balances appear to be fairly stated and recorded in the correct period. Credit Balance Testing Customner S Amount Gel Soap Powder Gum 75,879.00 i 117,847.00 i Cutoff Testing (Early Cuto Customer Penns Oil $ Amount | Memo # Date 96,541.617 2 The Bath & Body Shop 325,845.12 75,987.34 304112/17/20X3 3044 12/26/20X3 j 3045 12/30/20X3i Alligator Aid Cutoff Testing (Late Cuto Customer Mars Ligquid Detergents Silver Springs Drinks R Us $ Amount | Memo # Date 5,879.00 114,741.03 369,765.44 3046 1/2/20X4 I 3047 1/3/20X4 k 3051 1/14/20X4 k Tickmarks Based on the review of supporting documentation and discussion with management, credit amounts are due to customer overpayments. Traced and agreed the amount to supporting documentation. The customer was informed of the overpayment and will apply the credit to future purchases of the customer. The amount was reclassified as a liability. Please see "Other Liabilities" testing for further information. i eview Note 6 or 6: We still need to perform additional cutoff procedures due to this exception. Please perform the The amount was vouched and agreed to shipping/receiving documents and associated credit memo. The amount appears correctly classified as a credit for 20X3 The amount was vouched and agreed to shipping/receiving documents and associated credit memo. The amount aopears correctlv classified as a credit for 20X4 rocedures suggested in the firm guidance on misstatements found during tests of details

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts