Question: Could you help me answer this question step by step? A working paper elimination (in journal entry format) for Pigot Corporation and its wholly owned

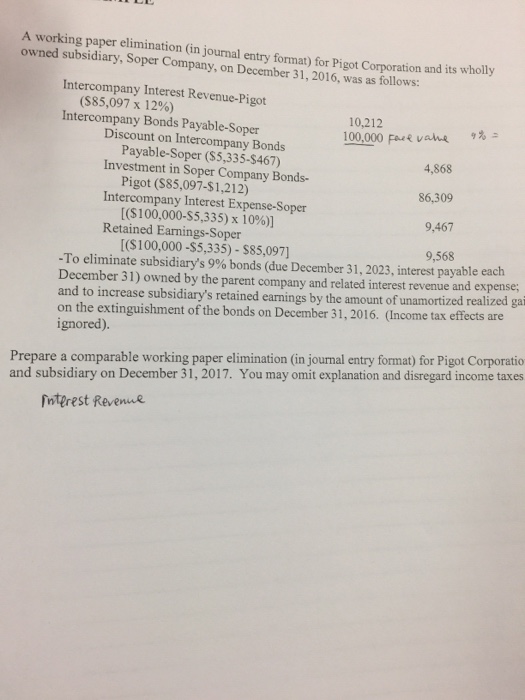

A working paper elimination (in journal entry format) for Pigot Corporation and its wholly owned subsidiary, Soper Company, on December 31, 2016, was as follows: Intercompany Interest Revenue-Pigot ($85,097 x 12%) Intercompany Bonds Payable-Soper 10,212 Discount on Intercompany Bonds Investment in Soper Company Bonds- Intercompany Interest Expense-Soper Retained Earnings-Soper Payable-Soper ($5,335-$467) Pigot (S85,097-$1,212) [SI 00.000-$5,335) x 10%)] [(S100,000-$5,335) - $85,097] 100,000 Fue vane 4,868 86,309 9,467 9,568 -To eliminate subsidiary's 9% bonds (due December 31, 2023, interest payable each December 31) owned by the parent company and related interest revenue and expense and to increase subsidiary's retained earnings by the amount of unamortized realized gai on the extinguishment of the bonds on December 31, 2016. (Income tax effects are ignored) Prepare a comparable working paper elimination (in journal entry format) for Pigot Corporatio and subsidiary on December 31, 2017. You may omit explanation and disregard income taxes Interest Revenue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts