Question: *Could you help me complete the vertical analysis for each year, and could you include the formulas so I understand the calculations? Consolidated Statements of

*Could you help me complete the vertical analysis for each year, and could you include the formulas so I understand the calculations?

*Could you help me complete the vertical analysis for each year, and could you include the formulas so I understand the calculations?

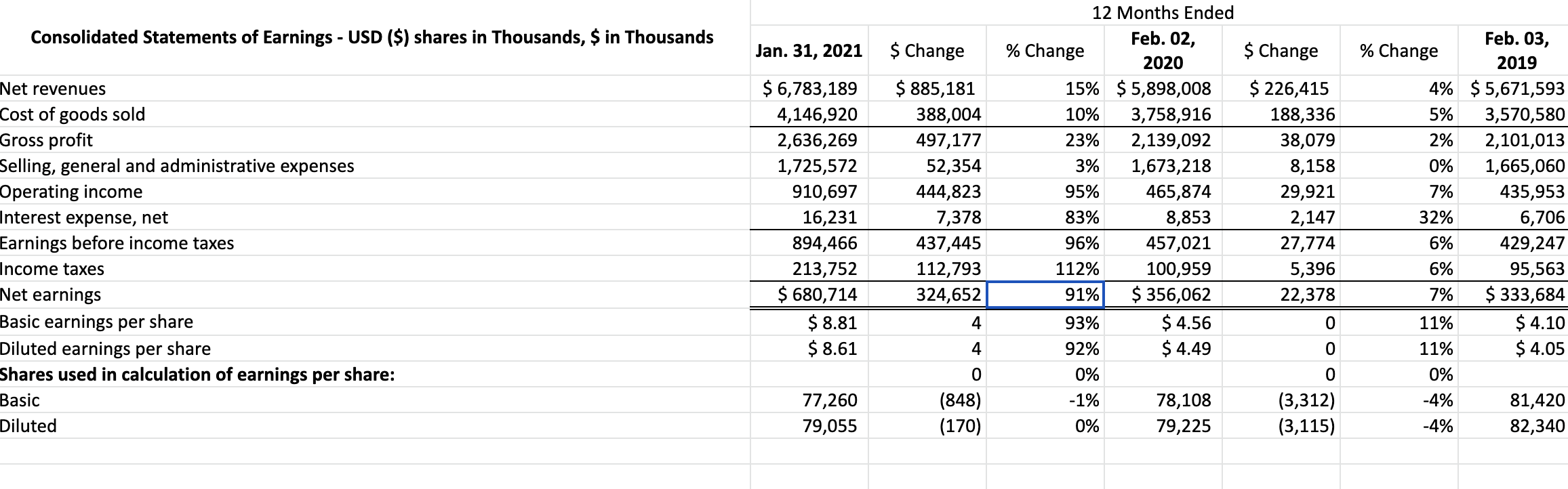

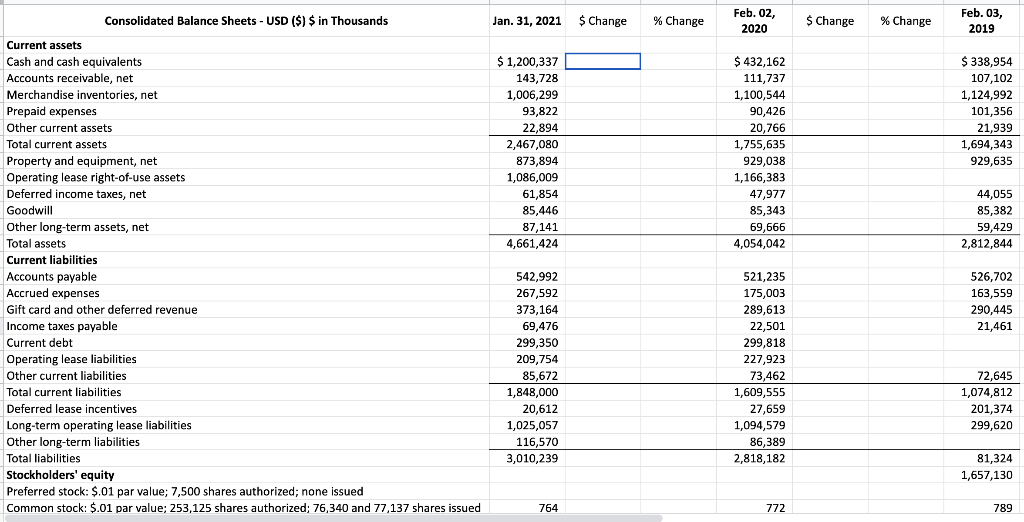

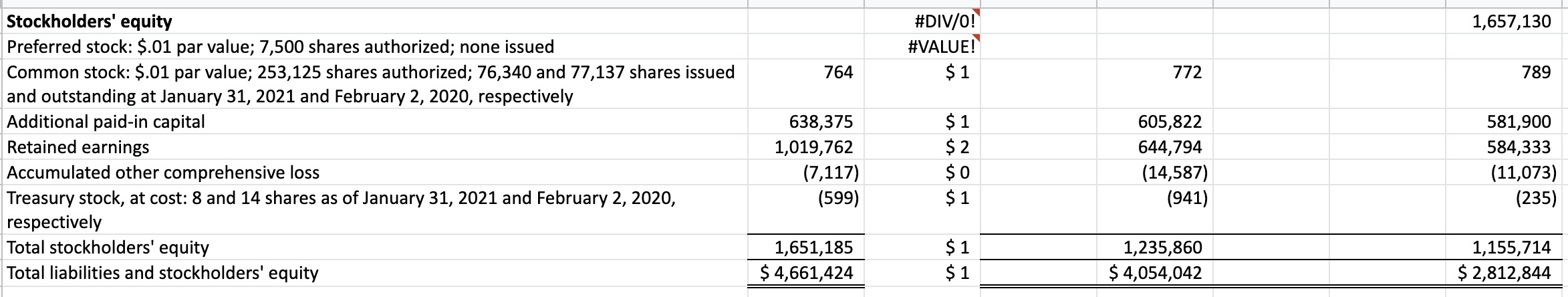

Consolidated Statements of Earnings - USD ($) shares in Thousands, $ in Thousands Jan. 31, 2021 $ Change Net revenues Cost of goods sold Gross profit Selling, general and administrative expenses Operating income Interest expense, net Earnings before income taxes Income taxes Net earnings Basic earnings per share Diluted earnings per share Shares used in calculation of earnings per share: Basic Diluted $ 6,783,189 4,146,920 2,636,269 1,725,572 910,697 16,231 894,466 213,752 $ 680,714 $ 8.81 $ 8.61 $ 885,181 388,004 497,177 52,354 444,823 7,378 437,445 112,793 324,652 4 12 Months Ended Feb. 02, % Change $ Change 2020 15% $ 5,898,008 $ 226,415 10% 3,758,916 188,336 23% 2,139,092 38,079 3% 1,673,218 8,158 95% 465,874 29,921 83% 8,853 2,147 96% 457,021 27,774 112% 100,959 5,396 91% $ 356,062 22,378 93% $ 4.56 0 92% $ 4.49 0 0% 0 -1% 78,108 (3,312) 0% 79,225 (3,115) Feb. 03, % Change 2019 4% $ 5,671,593 5% 3,570,580 2% 2,101,013 0% 1,665,060 7% 435,953 32% 6,706 6% 429,247 6% 95,563 7% $333,684 11% $ 4.10 11% $ 4.05 0% -4% 81,420 -4% 82,340 4 0 77,260 79,055 (848) (170) Jan. 31, 2021 $ Change % Change Feb. 02, 2020 $ Change % Change Feb. 03, 2019 $ 338,954 107,102 1,124,992 101,356 $ 1,200,337 143,728 1,006,299 93,822 22,894 2,467,080 873,894 1,086,009 61,854 85,446 87,141 4,661,424 $ 432,162 111,737 1,100,544 90,426 20,766 1,755,635 929,038 1,166,383 47,977 85,343 69,666 4,054,042 21,939 1,694,343 929,635 44,055 85,382 59,429 2,812,844 Consolidated Balance Sheets - USD ($) $ in Thousands Current assets Cash and cash equivalents Accounts receivable, net , Merchandise inventories, net Prepaid expenses Other current assets Total current assets Property and equipment, net Operating lease right-of-use assets Deferred income taxes, net Goodwill Other long-term assets, net To Total assets Current liabilities Accounts payable Accrued expenses Gift card and other deferred revenue Income taxes payable TAGS Current debt Operating lease liabilities Other current liabilities Total current liabilities Deferred lease incentives Long-term operating lease liabilities Other long-term liabilities Total liabilities Stockholders' equity Preferred stock: $.01 par value; 7,500 shares authorized; none issued Common stock: $.01 par value; 253,125 shares authorized; 76,340 and 77,137 shares issued 526,702 163,559 290,445 21,461 542,992 267,592 373,164 69,476 299,350 209,754 85,672 1,848,000 20,612 1,025,057 116,570 3,010,239 521,235 175,003 289,613 22,501 299,818 227,923 73,462 1,609,555 27,659 72,645 1,074,812 201,374 299,620 1,094,579 86,389 2,818,182 81,324 1,657,130 764 772 789 1,657,130 #DIV/0! #VALUE! $1 764 772 789 Stockholders' equity Preferred stock: $.01 par value; 7,500 shares authorized; none issued Common stock: $.01 par value; 253,125 shares authorized; 76,340 and 77,137 shares issued and outstanding at January 31, 2021 and February 2, 2020, respectively Additional paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, at cost: 8 and 14 shares as of January 31, 2021 and February 2, 2020, respectively Total stockholders' equity Total liabilities and stockholders' equity 638,375 1,019,762 (7,117) (599) $ 1 $ 2 $ 0 $ 1 605,822 644,794 (14,587) (941) 581,900 584,333 (11,073) (235) 1,651,185 $ 4,661,424 $ 1 $ 1 1,235,860 $ 4,054,042 1,155,714 $ 2,812,844

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts