Question: Could you help me in this question please, the excel data needed for this question is here. Thank you (Calibration of term structure model) Refer

Could you help me in this question please, the excel data needed for this question is here. Thank you

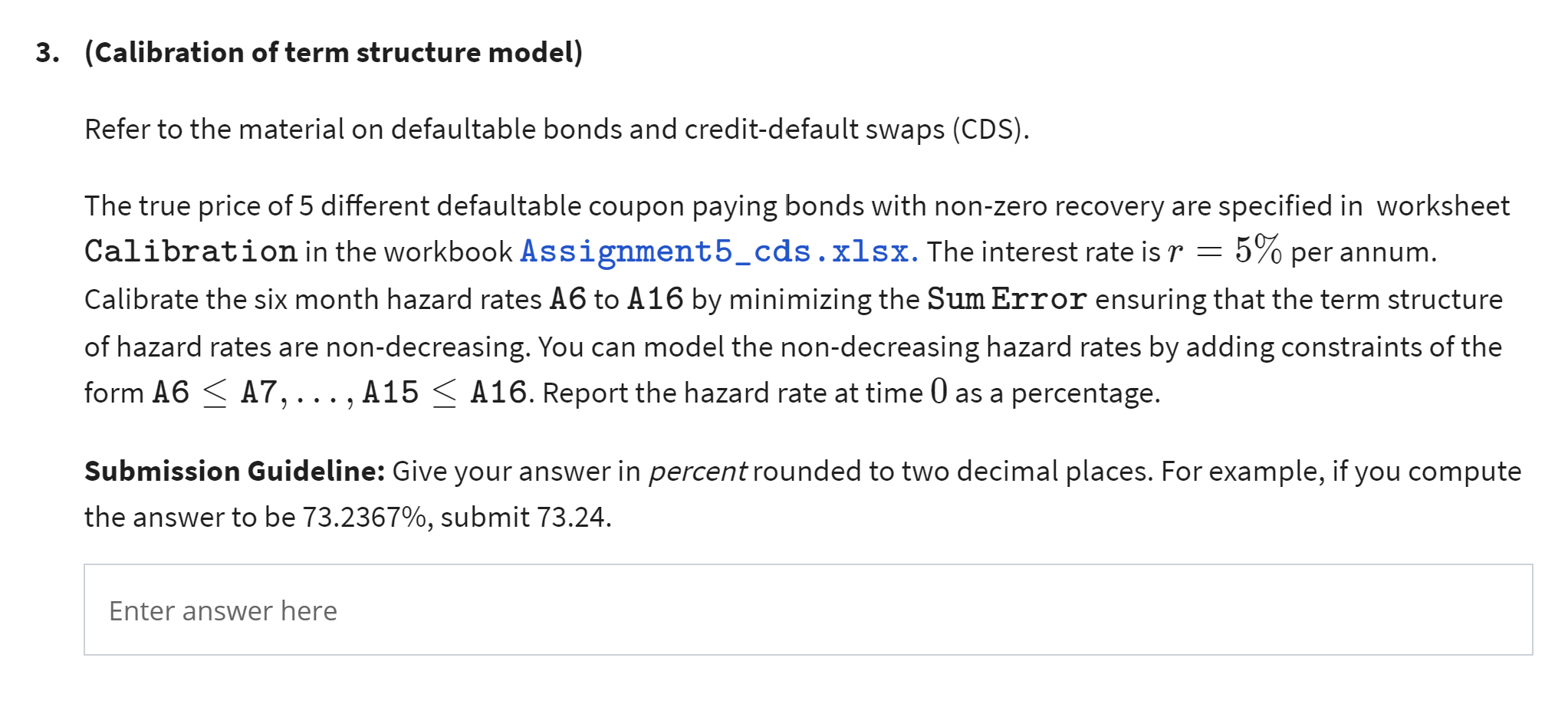

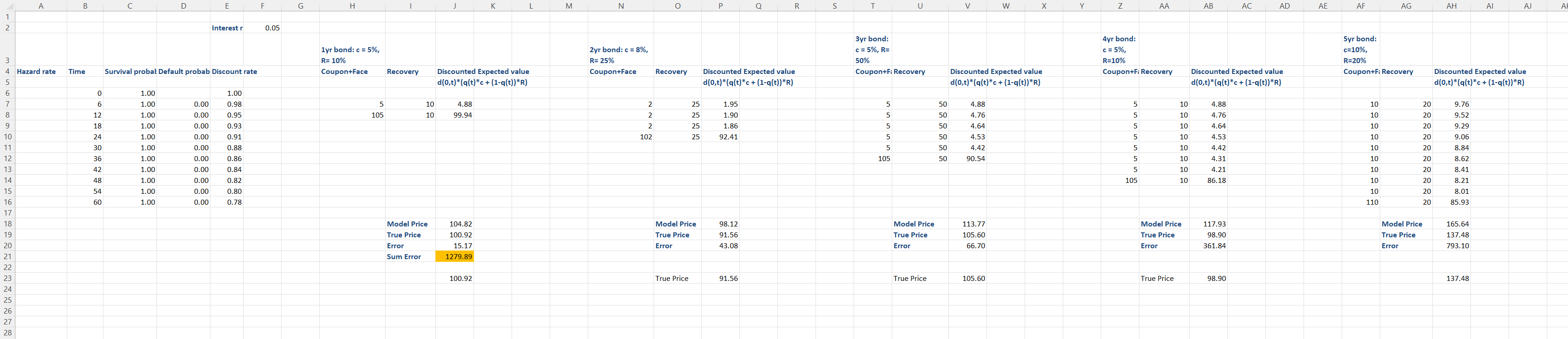

(Calibration of term structure model) Refer to the material on defaultable bonds and credit-default swaps (CDS). The true price of 5 different defaultable coupon paying bonds with non-zero recovery are specified in worksheet Calibration in the workbook Assignment5_cds. XIsx. The interest rate is r=5% per annum. Calibrate the six month hazard rates A6 to A16 by minimizing the Sum Error ensuring that the term structure of hazard rates are non-decreasing. You can model the non-decreasing hazard rates by adding constraints of the form A6A7,,A15A16. Report the hazard rate at time 0 as a percentage. Submission Guideline: Give your answer in percent rounded to two decimal places. For example, if you compute the answer to be 73.2367%, submit 73.24 . (Calibration of term structure model) Refer to the material on defaultable bonds and credit-default swaps (CDS). The true price of 5 different defaultable coupon paying bonds with non-zero recovery are specified in worksheet Calibration in the workbook Assignment5_cds. XIsx. The interest rate is r=5% per annum. Calibrate the six month hazard rates A6 to A16 by minimizing the Sum Error ensuring that the term structure of hazard rates are non-decreasing. You can model the non-decreasing hazard rates by adding constraints of the form A6A7,,A15A16. Report the hazard rate at time 0 as a percentage. Submission Guideline: Give your answer in percent rounded to two decimal places. For example, if you compute the answer to be 73.2367%, submit 73.24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts