Question: Could you help me with this assignment? The professors slides are a jumbled mess. Also could you provide a step by step response (just numbers

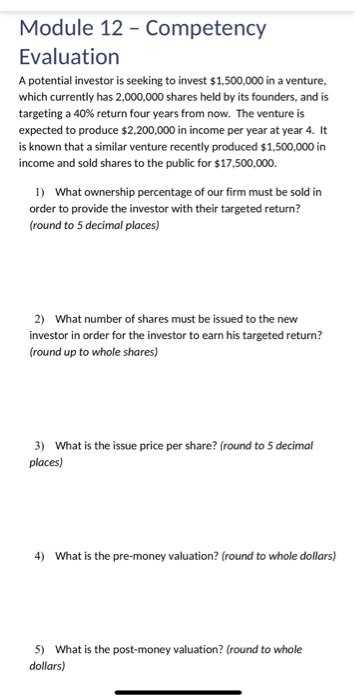

Module 12 - Competency Evaluation A potential investor is seeking to invest $1,500,000 in a venture, which currently has 2,000,000 shares held by its founders, and is targeting a 40% return four years from now. The venture is expected to produce $2,200,000 in income per year at year 4. It is known that a similar venture recently produced $1,500,000 in income and sold shares to the public for $17,500,000. 1) What ownership percentage of our firm must be sold in order to provide the investor with their targeted return? (round to 5 decimal places) 2) What number of shares must be issued to the new investor in order for the investor to earn his targeted return? (round up to whole shares) 3) What is the issue price per share? (round to 5 decimal places) 4) What is the pre-money valuation? (round to whole dollars) 5) What is the post-money valuation? (round to whole dollars)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts