Question: Could you help with question 3 Explain the International Banking Act of 1978. Please describe the four different types of international financial centers. Suppose Bank

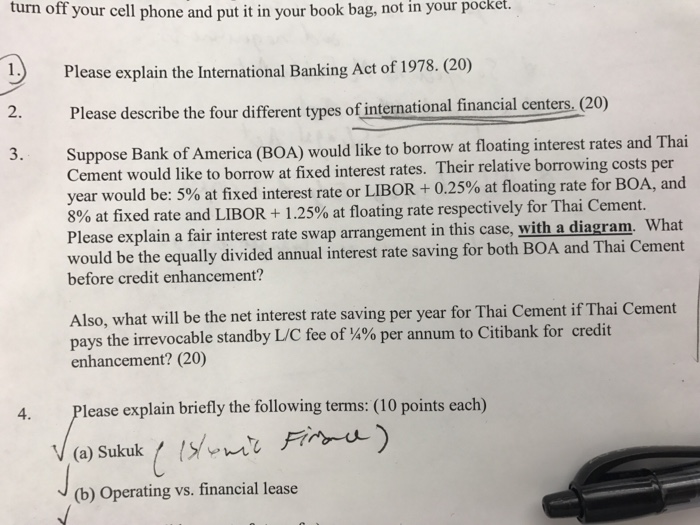

Explain the International Banking Act of 1978. Please describe the four different types of international financial centers. Suppose Bank of America (BOA) would like to borrow at floating interest rates and Thai Cement would like to borrow at fixed interest rates. Their relative borrowing costs per year would be: 5% at fixed interest rate or LIBOR + 0.25% at floating rate for BOA, and 8% at fixed rate and LIBOR + 1.25% at floating rate respectively for Thai Cement. Please explain a fair interest rate swap arrangement in this case, with a diagram. What would be the equally divided annual interest rate saving for both BOA and Thai Cement before credit enhancement? Also, what will be the net interest rate saving per year for Thai Cement if Thai Cement pays the irrevocable standby L/C fee of %% per annum to Citibank for credit enhancement? Please explain briefly the following terms: Sukuk Operating vs. financial lease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts