Question: Could you input it with these answers please. Vaughn Corp has 149,440 shares of common stock outstanding. In 2025 , the compary reports income from

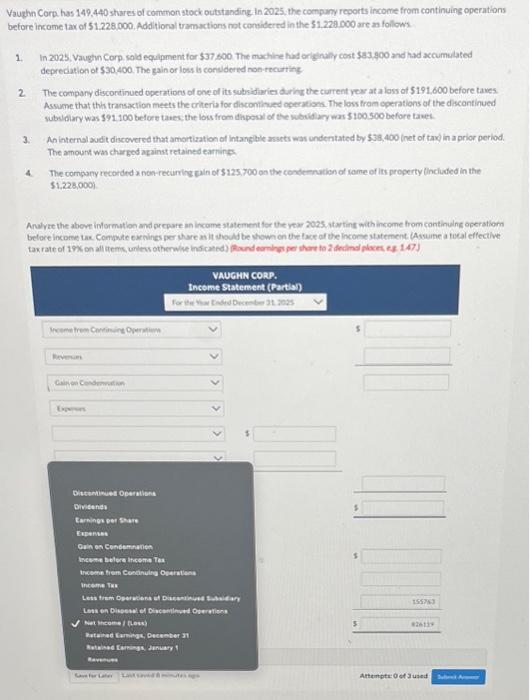

Vaughn Corp has 149,440 shares of common stock outstanding. In 2025 , the compary reports income from continuing operations before income tax of 51.228.000, Additional tramactions not coneidered in the 51.220.000 are an follows 1. In 2025, Vaughin Corp. sold equipment for $37,600 The muchine had orignaly cost $83,900 and had accumulated depreciation of $30,400. The gain or loss is considered non-recurting. 2. The company discontinued operations of one of its subsidiaries during the current year at a lass of $191.600 before taves. Assume that this transaction meets the criteria for disconticued ogerations. The loss fram operations af the discontinued subvidiary was $91100 belore taves, the bus from disposal of the wibrid ary was 5100.500 betore tives. 3. An internsl audit discovered that amortization of intangible assets was underntated by 539,400 (net of taxd in aprior period. The amourt was charged apainst retained earninga 4. The company recorded a non-recurrive eain of 5125,700 on the condemucion of tame of its property fincluded in the 51,228,0001 Arulyre the above information and prepare an income statement for the year 2025 . starting with income from continuling operation betore income tax. Conpuse earnines per iture as it thould be thown on the tace of the income statement (Assume a tocal effective

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts