Question: Could you please answer 4th question, my answer in 3rd one is correct. Thanks! 1 point 3. Consider a company founded with 1m shares of

Could you please answer 4th question, my answer in 3rd one is correct. Thanks!

Could you please answer 4th question, my answer in 3rd one is correct. Thanks!

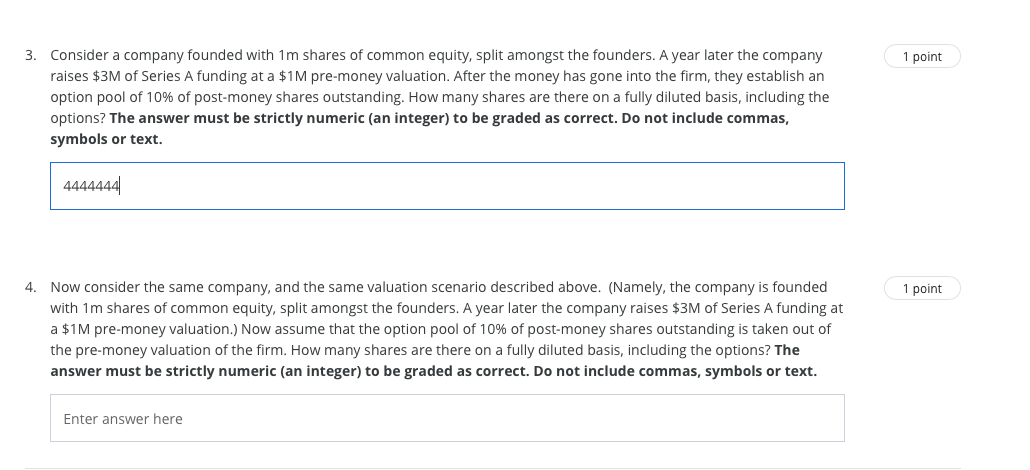

1 point 3. Consider a company founded with 1m shares of common equity, split amongst the founders. A year later the company raises $3M of Series A funding at a $1M pre-money valuation. After the money has gone into the firm, they establish an option pool of 10% of post-money shares outstanding. How many shares are there on a fully diluted basis, including the options? The answer must be strictly numeric (an integer) to be graded as correct. Do not include commas, symbols or text. 4444444 1 point 4. Now consider the same company, and the same valuation scenario described above. (Namely, the company is founded with 1m shares of common equity, split amongst the founders. A year later the company raises $3M of Series A funding at a $1M pre-money valuation.) Now assume that the option pool of 10% of post-money shares outstanding is taken out of the pre-money valuation of the firm. How many shares are there on a fully diluted basis, including the options? The answer must be strictly numeric (an integer) to be graded as correct. Do not include commas, symbols or text. Enter answer here 1 point 3. Consider a company founded with 1m shares of common equity, split amongst the founders. A year later the company raises $3M of Series A funding at a $1M pre-money valuation. After the money has gone into the firm, they establish an option pool of 10% of post-money shares outstanding. How many shares are there on a fully diluted basis, including the options? The answer must be strictly numeric (an integer) to be graded as correct. Do not include commas, symbols or text. 4444444 1 point 4. Now consider the same company, and the same valuation scenario described above. (Namely, the company is founded with 1m shares of common equity, split amongst the founders. A year later the company raises $3M of Series A funding at a $1M pre-money valuation.) Now assume that the option pool of 10% of post-money shares outstanding is taken out of the pre-money valuation of the firm. How many shares are there on a fully diluted basis, including the options? The answer must be strictly numeric (an integer) to be graded as correct. Do not include commas, symbols or text. Enter answer here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts