Question: Could you please answer all the question from 2 to 8 please Sweeten Company had no overapplied or underapplied manufacturing overhead costs during the year.

Could you please answer all the question from 2 to 8 please

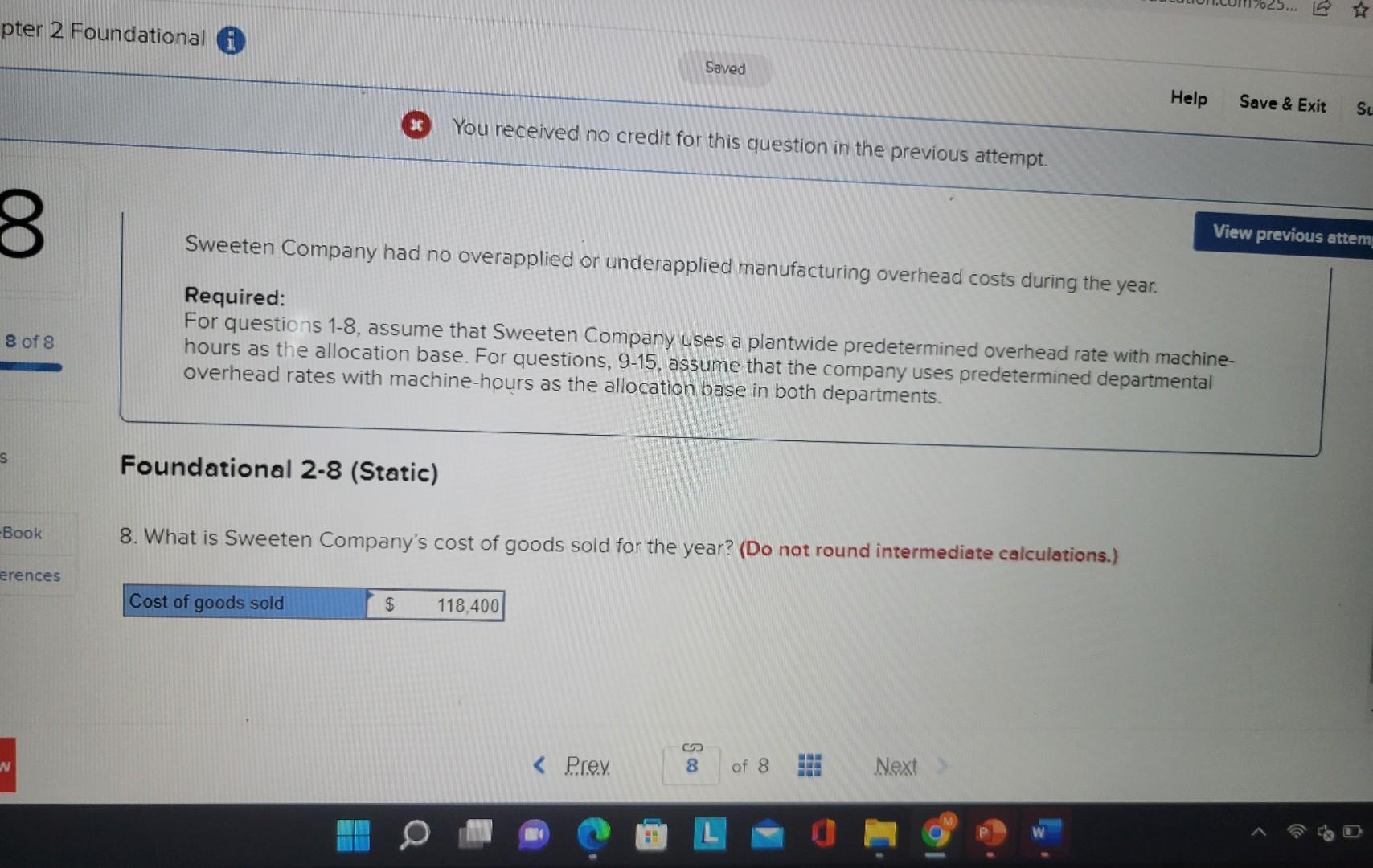

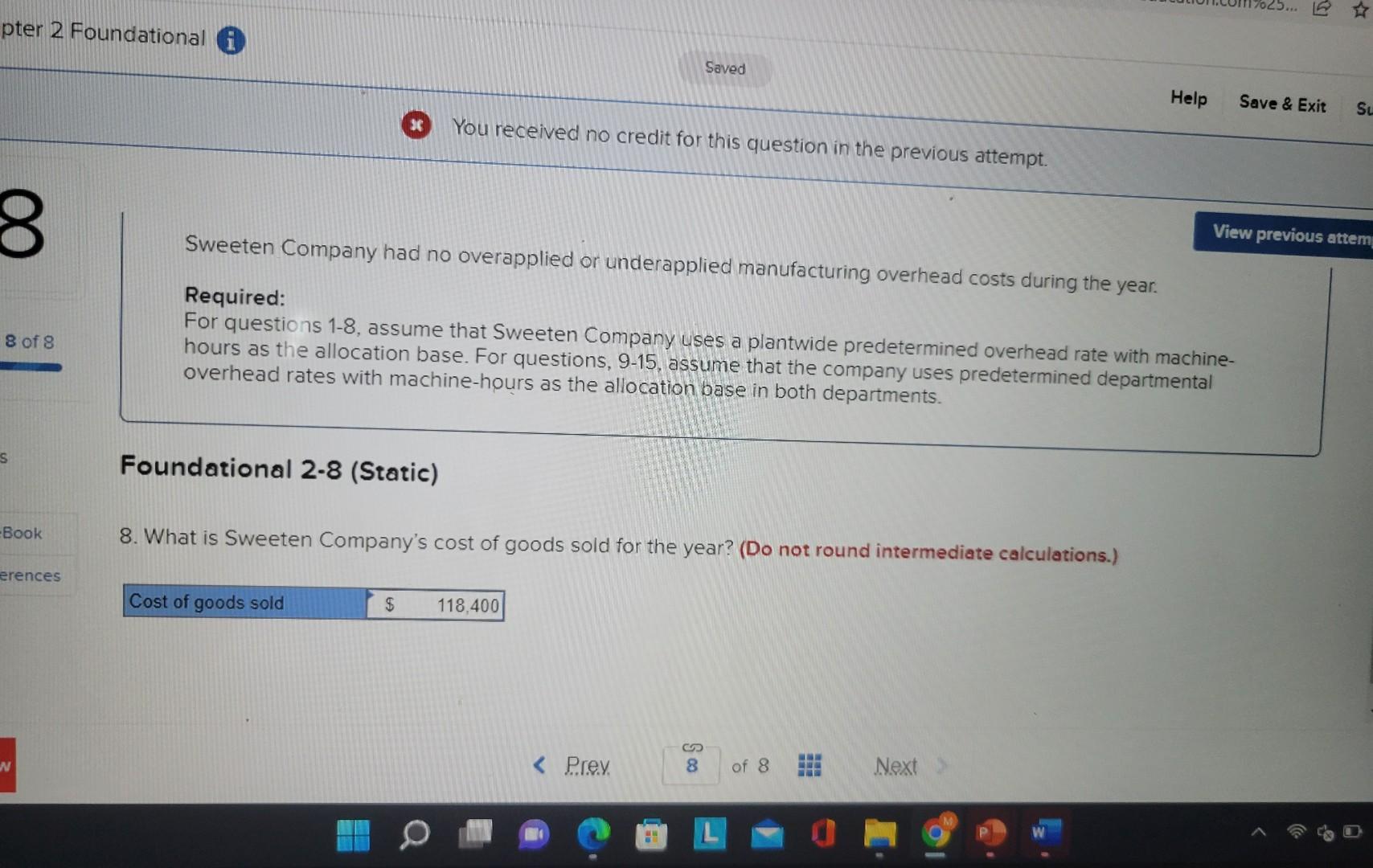

Sweeten Company had no overapplied or underapplied manufacturing overhead costs during the year. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machinehours as the allocation base. For questions, 9-15, assume that the company uses predetermined departmental overhead rates with machine-hours as the allocation base in both departments. Foundational 2-8 (Static) 8. What is Sweeten Company's cost of goods sold for the year? (Do not round intermediate calculations.) Sweeten Company had no overapplied or underapplied manufacturing overhead costs during the year. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machinehours as the allocation base. For questions, 9-15, assume that the company uses predetermined departmental overhead rates with machine-hours as the allocation base in both departments. Foundational 2-8 (Static) 8. What is Sweeten Company's cost of goods sold for the year? (Do not round intermediate calculations.) Sweeten Company had no overapplied or underapplied manufacturing overhead costs during the year. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machinehours as the allocation base. For questions, 9-15, assume that the company uses predetermined departmental overhead rates with machine-hours as the allocation base in both departments. Foundational 2-8 (Static) 8. What is Sweeten Company's cost of goods sold for the year? (Do not round intermediate calculations.) Sweeten Company had no overapplied or underapplied manufacturing overhead costs during the year. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machinehours as the allocation base. For questions, 9-15, assume that the company uses predetermined departmental overhead rates with machine-hours as the allocation base in both departments. Foundational 2-8 (Static) 8. What is Sweeten Company's cost of goods sold for the year? (Do not round intermediate calculations.) Sweeten Company had no overapplied or underapplied manufacturing overhead costs during the year. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machinehours as the allocation base. For questions, 9-15, assume that the company uses predetermined departmental overhead rates with machine-hours as the allocation base in both departments. Foundational 2-8 (Static) 8. What is Sweeten Company's cost of goods sold for the year? (Do not round intermediate calculations.) Sweeten Company had no overapplied or underapplied manufacturing overhead costs during the year. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machinehours as the allocation base. For questions, 9-15, assume that the company uses predetermined departmental overhead rates with machine-hours as the allocation base in both departments. Foundational 2-8 (Static) 8. What is Sweeten Company's cost of goods sold for the year? (Do not round intermediate calculations.) Sweeten Company had no overapplied or underapplied manufacturing overhead costs during the year. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machinehours as the allocation base. For questions, 9-15, assume that the company uses predetermined departmental overhead rates with machine-hours as the allocation base in both departments. Foundational 2-8 (Static) 8. What is Sweeten Company's cost of goods sold for the year? (Do not round intermediate calculations.) Sweeten Company had no overapplied or underapplied manufacturing overhead costs during the year. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machinehours as the allocation base. For questions, 9-15, assume that the company uses predetermined departmental overhead rates with machine-hours as the allocation base in both departments. Foundational 2-8 (Static) 8. What is Sweeten Company's cost of goods sold for the year? (Do not round intermediate calculations.) Sweeten Company had no overapplied or underapplied manufacturing overhead costs during the year. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machinehours as the allocation base. For questions, 9-15, assume that the company uses predetermined departmental overhead rates with machine-hours as the allocation base in both departments. Foundational 2-8 (Static) 8. What is Sweeten Company's cost of goods sold for the year? (Do not round intermediate calculations.) Sweeten Company had no overapplied or underapplied manufacturing overhead costs during the year. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machinehours as the allocation base. For questions, 9-15, assume that the company uses predetermined departmental overhead rates with machine-hours as the allocation base in both departments. Foundational 2-8 (Static) 8. What is Sweeten Company's cost of goods sold for the year? (Do not round intermediate calculations.) Sweeten Company had no overapplied or underapplied manufacturing overhead costs during the year. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machinehours as the allocation base. For questions, 9-15, assume that the company uses predetermined departmental overhead rates with machine-hours as the allocation base in both departments. Foundational 2-8 (Static) 8. What is Sweeten Company's cost of goods sold for the year? (Do not round intermediate calculations.) Sweeten Company had no overapplied or underapplied manufacturing overhead costs during the year. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machinehours as the allocation base. For questions, 9-15, assume that the company uses predetermined departmental overhead rates with machine-hours as the allocation base in both departments. Foundational 2-8 (Static) 8. What is Sweeten Company's cost of goods sold for the year? (Do not round intermediate calculations.) Sweeten Company had no overapplied or underapplied manufacturing overhead costs during the year. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machinehours as the allocation base. For questions, 9-15, assume that the company uses predetermined departmental overhead rates with machine-hours as the allocation base in both departments. Foundational 2-8 (Static) 8. What is Sweeten Company's cost of goods sold for the year? (Do not round intermediate calculations.) Sweeten Company had no overapplied or underapplied manufacturing overhead costs during the year. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machinehours as the allocation base. For questions, 9-15, assume that the company uses predetermined departmental overhead rates with machine-hours as the allocation base in both departments. Foundational 2-8 (Static) 8. What is Sweeten Company's cost of goods sold for the year? (Do not round intermediate calculations.) Sweeten Company had no overapplied or underapplied manufacturing overhead costs during the year. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machinehours as the allocation base. For questions, 9-15, assume that the company uses predetermined departmental overhead rates with machine-hours as the allocation base in both departments. Foundational 2-8 (Static) 8. What is Sweeten Company's cost of goods sold for the year? (Do not round intermediate calculations.) Sweeten Company had no overapplied or underapplied manufacturing overhead costs during the year. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machinehours as the allocation base. For questions, 9-15, assume that the company uses predetermined departmental overhead rates with machine-hours as the allocation base in both departments. Foundational 2-8 (Static) 8. What is Sweeten Company's cost of goods sold for the year? (Do not round intermediate calculations.) Sweeten Company had no overapplied or underapplied manufacturing overhead costs during the year. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machinehours as the allocation base. For questions, 9-15, assume that the company uses predetermined departmental overhead rates with machine-hours as the allocation base in both departments. Foundational 2-8 (Static) 8. What is Sweeten Company's cost of goods sold for the year? (Do not round intermediate calculations.) Sweeten Company had no overapplied or underapplied manufacturing overhead costs during the year. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machinehours as the allocation base. For questions, 9-15, assume that the company uses predetermined departmental overhead rates with machine-hours as the allocation base in both departments. Foundational 2-8 (Static) 8. What is Sweeten Company's cost of goods sold for the year? (Do not round intermediate calculations.) Sweeten Company had no overapplied or underapplied manufacturing overhead costs during the year. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machinehours as the allocation base. For questions, 9-15, assume that the company uses predetermined departmental overhead rates with machine-hours as the allocation base in both departments. Foundational 2-8 (Static) 8. What is Sweeten Company's cost of goods sold for the year? (Do not round intermediate calculations.) Sweeten Company had no overapplied or underapplied manufacturing overhead costs during the year. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machinehours as the allocation base. For questions, 9-15, assume that the company uses predetermined departmental overhead rates with machine-hours as the allocation base in both departments. Foundational 2-8 (Static) 8. What is Sweeten Company's cost of goods sold for the year? (Do not round intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts