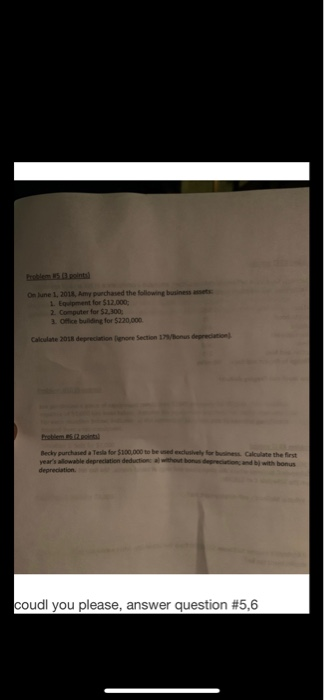

Question: could you please answer question #5,6 roblem #53 points) On June 1, 2018, Amy purchased the following business assets 1. Equipment for $12.000 2. Computer

roblem #53 points) On June 1, 2018, Amy purchased the following business assets 1. Equipment for $12.000 2. Computer for $2,300 3 Office bulding for $220,000 Calculate 2018 depreciation gnore Section 179/onus depreciation froblem (2points Becky purchased a Tesla for $100,000 to be used exclusively for buniness Calculate the first vear's allowable depreciation deduction: al without bonus depreciation and bi with bonus depreciation coudl you please, answer question # 5,6 roblem #53 points) On June 1, 2018, Amy purchased the following business assets 1. Equipment for $12.000 2. Computer for $2,300 3 Office bulding for $220,000 Calculate 2018 depreciation gnore Section 179/onus depreciation froblem (2points Becky purchased a Tesla for $100,000 to be used exclusively for buniness Calculate the first vear's allowable depreciation deduction: al without bonus depreciation and bi with bonus depreciation coudl you please, answer question # 5,6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts