Question: Could you please answer the two questions listed below the table? Thanks! Chapter 7: Capital Asset Pricing and Arbitrage Pricing Theory 17. Suppose that the

Could you please answer the two questions listed below the table? Thanks!

Could you please answer the two questions listed below the table? Thanks!

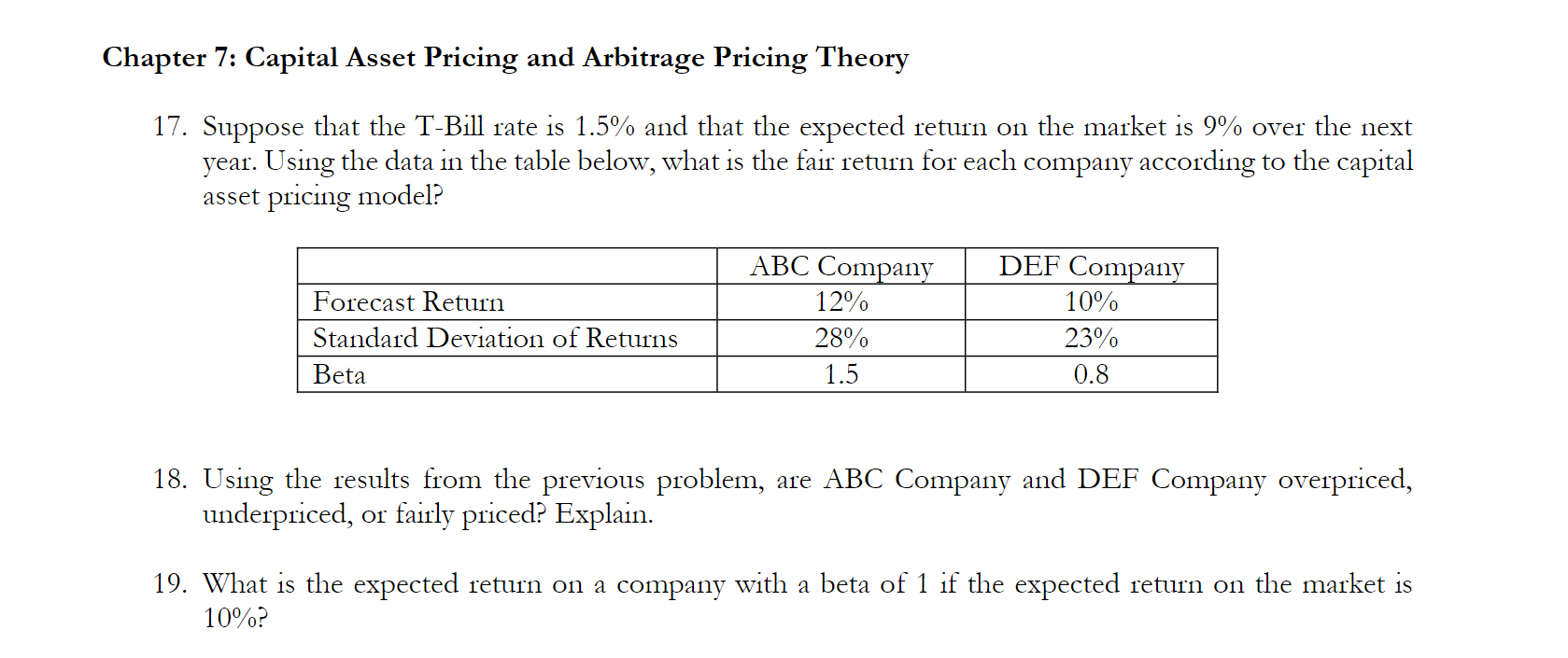

Chapter 7: Capital Asset Pricing and Arbitrage Pricing Theory 17. Suppose that the T-Bill rate is 1.5% and that the expected return on the market is 9% over the next year. Using the data in the table below, what is the fair return for each company according to the capital asset pricing model? Forecast Return Standard Deviation of Returns Beta ABC Company 12% 28% DEF Company 10% 23% 0.8 1.5 18. Using the results from the previous problem, are ABC Company and DEF Company overpriced, underpriced, or fairly priced? Explain. 19. What is the expected return on a company with a beta of 1 if the expected return on the market is 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts